Technological Advancements in AI and Robotics

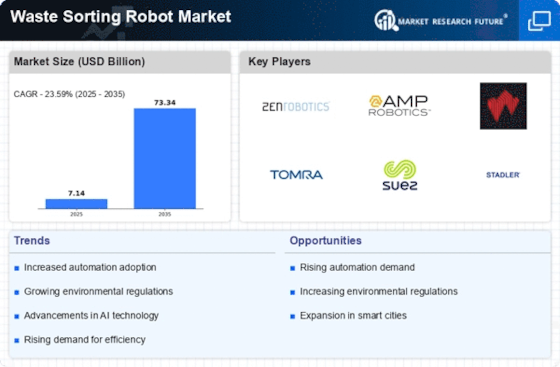

The Waste Sorting Robot Market is experiencing a surge in technological advancements, particularly in artificial intelligence and robotics. These innovations enhance the efficiency and accuracy of waste sorting processes. For instance, the integration of machine learning algorithms allows robots to identify and categorize waste materials with remarkable precision. As a result, the operational efficiency of waste management facilities improves significantly. According to recent data, the adoption of advanced robotics in waste sorting has led to a reduction in labor costs by approximately 30%. This trend indicates a strong potential for growth in the Waste Sorting Robot Market, as companies seek to leverage these technologies to optimize their operations and reduce environmental impact.

Economic Benefits of Automation in Waste Management

The Waste Sorting Robot Market is witnessing a shift towards automation due to the economic benefits associated with robotic solutions. Automation in waste sorting not only reduces labor costs but also enhances operational efficiency. Companies are increasingly recognizing that investing in waste sorting robots can lead to long-term savings and improved profitability. Data suggests that facilities utilizing automated sorting systems experience a 20% increase in throughput, allowing them to process more waste in less time. This economic rationale is likely to propel the adoption of waste sorting robots, as organizations seek to optimize their waste management processes while maintaining cost-effectiveness in a competitive market.

Increasing Regulatory Pressure for Waste Management

The Waste Sorting Robot Market is influenced by increasing regulatory pressure aimed at improving waste management practices. Governments are implementing stringent regulations to promote recycling and reduce landfill waste. This regulatory environment encourages municipalities and waste management companies to invest in automated solutions, such as waste sorting robots. For example, recent legislation mandates that a certain percentage of waste must be recycled, driving the demand for efficient sorting technologies. The market is projected to grow as organizations strive to comply with these regulations, potentially increasing the adoption of waste sorting robots by over 25% in the coming years. This trend underscores the critical role of regulatory frameworks in shaping the Waste Sorting Robot Market.

Rising Environmental Concerns and Sustainability Initiatives

The Waste Sorting Robot Market is significantly impacted by rising environmental concerns and the push for sustainability initiatives. As awareness of environmental issues grows, there is an increasing demand for effective waste management solutions that minimize ecological footprints. Waste sorting robots play a crucial role in this context by enhancing recycling rates and reducing contamination in recyclable materials. Recent studies indicate that implementing automated sorting systems can increase recycling efficiency by up to 50%. This heightened focus on sustainability is likely to drive investments in waste sorting technologies, positioning the Waste Sorting Robot Market for substantial growth as businesses and governments prioritize eco-friendly practices.

Technological Integration with Smart Waste Management Systems

The Waste Sorting Robot Market is evolving through the integration of waste sorting robots with smart waste management systems. This integration allows for real-time monitoring and data analytics, enhancing the overall efficiency of waste management operations. By utilizing IoT technology, waste sorting robots can communicate with other systems to optimize sorting processes and improve decision-making. Recent market analyses indicate that the combination of smart technologies with waste sorting solutions could lead to a 40% improvement in operational efficiency. As cities and organizations increasingly adopt smart waste management strategies, the demand for waste sorting robots is expected to rise, indicating a promising trajectory for the Waste Sorting Robot Market.