Emerging Focus on Stem Cell Research

The Global Cell Sorting Market Industry is significantly influenced by the emerging focus on stem cell research, which holds promise for regenerative medicine and tissue engineering. Cell sorting technologies are essential for isolating specific stem cell populations, enabling researchers to study their properties and potential applications in therapy. As the field of regenerative medicine expands, the demand for precise cell sorting solutions is expected to rise. This trend aligns with the projected market growth to 53.6 USD Billion by 2035, indicating a strong interest in harnessing the capabilities of stem cells for innovative medical treatments. The integration of cell sorting in stem cell research is likely to yield transformative outcomes.

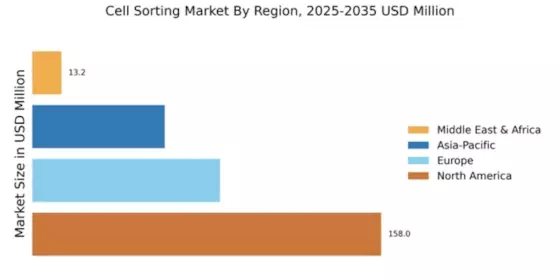

Market Growth Projections and Trends

The Global Cell Sorting Market Industry is characterized by robust growth projections, with expectations of reaching 53.6 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 8.0% from 2025 to 2035, reflecting the increasing adoption of cell sorting technologies across various sectors. The market's expansion is driven by factors such as rising demand for personalized medicine, advancements in technology, and increased investment in research and development. These trends suggest a dynamic landscape for the cell sorting industry, where innovation and application diversity are likely to shape future developments.

Growing Applications in Cancer Research

The Global Cell Sorting Market Industry is witnessing a notable expansion due to its growing applications in cancer research. Cell sorting technologies enable researchers to isolate and analyze tumor cells, facilitating the understanding of cancer biology and the development of targeted therapies. This is particularly relevant as the global burden of cancer continues to rise, necessitating innovative approaches to treatment. The market's growth trajectory, projected to reach 23 USD Billion in 2024, reflects the increasing recognition of the importance of cell sorting in advancing cancer research. As the industry evolves, it is likely to play a pivotal role in the quest for more effective cancer treatments.

Increasing Demand for Precision Medicine

The Global Cell Sorting Market Industry is experiencing a surge in demand for precision medicine, which emphasizes the need for tailored therapeutic approaches based on individual cellular profiles. This trend is driven by advancements in genomics and biotechnology, enabling researchers to isolate specific cell types for targeted treatments. As the market evolves, the industry is projected to reach 23 USD Billion in 2024, reflecting a growing recognition of the importance of cell sorting in personalized healthcare. The ability to accurately sort and analyze cells is crucial for developing effective therapies, thereby enhancing patient outcomes and driving further investment in cell sorting technologies.

Rising Investment in Research and Development

Investment in research and development is a key driver of the Global Cell Sorting Market Industry, as both public and private sectors recognize the potential of cell sorting technologies in advancing scientific knowledge. Increased funding for biomedical research, particularly in areas such as regenerative medicine and cellular therapies, is likely to propel the demand for sophisticated cell sorting solutions. This trend is evident in the projected compound annual growth rate of 8.0% from 2025 to 2035, indicating a robust commitment to innovation in the field. As researchers seek to unlock new therapeutic avenues, the reliance on effective cell sorting methodologies will continue to grow.

Technological Advancements in Cell Sorting Techniques

Technological innovations are significantly shaping the Global Cell Sorting Market Industry, with advancements in microfluidics, fluorescence-activated cell sorting, and acoustic sorting methods. These technologies enhance the efficiency and accuracy of cell sorting processes, allowing for the rapid isolation of specific cell populations. As a result, researchers can conduct more detailed analyses, leading to breakthroughs in various fields such as immunology and cancer research. The anticipated growth of the market to 53.6 USD Billion by 2035 underscores the critical role that these technological advancements play in driving the industry forward, as they facilitate the exploration of complex biological systems.