Technological Innovations

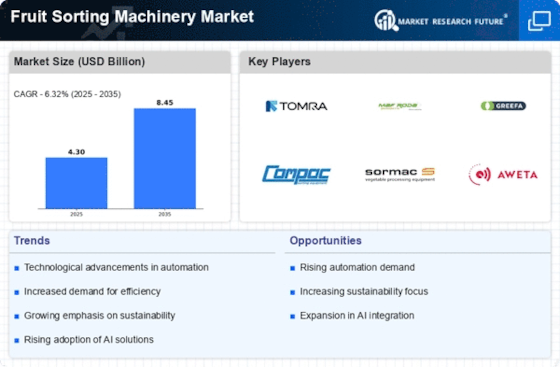

Technological advancements play a crucial role in shaping the Fruit Sorting Machinery Market. Innovations such as artificial intelligence, machine learning, and advanced imaging technologies are revolutionizing sorting processes. These technologies enable machines to assess fruit quality with unprecedented accuracy, thus enhancing sorting efficiency. For instance, the integration of AI can lead to a 25% improvement in sorting precision. As these technologies continue to evolve, they are expected to drive the demand for more sophisticated sorting machinery, compelling manufacturers to invest in research and development to stay competitive in the market.

Growing Export Opportunities

The expansion of international trade in fruits is a significant driver for the Fruit Sorting Machinery Market. As countries seek to export their produce to meet global demand, the need for efficient sorting machinery becomes paramount. Exporters must ensure that their products meet stringent quality standards, which often necessitates the use of advanced sorting technologies. Recent statistics suggest that the export of fresh fruits is expected to grow by 4.5% annually, creating a robust market for sorting machinery. This trend indicates that manufacturers who can provide reliable and efficient sorting solutions are likely to benefit from increased demand in the export sector.

Automation and Labor Efficiency

The push towards automation in agricultural practices significantly influences the Fruit Sorting Machinery Market. As labor costs rise and the availability of skilled labor diminishes, producers are increasingly turning to automated sorting solutions. These machines not only enhance efficiency but also reduce the likelihood of human error, thereby improving overall productivity. Data indicates that the adoption of automated sorting machinery can lead to a 30% increase in sorting speed compared to manual processes. This trend suggests that manufacturers who provide advanced, automated sorting solutions are likely to capture a larger share of the market, as producers seek to optimize their operations.

Rising Demand for Quality Produce

The increasing consumer preference for high-quality fruits is a pivotal driver in the Fruit Sorting Machinery Market. As consumers become more discerning, the demand for uniformity in size, color, and ripeness intensifies. This trend compels producers to invest in advanced sorting technologies to meet market expectations. According to recent data, the market for high-quality fruits is projected to grow at a rate of 5.2% annually, thereby necessitating efficient sorting solutions. Consequently, manufacturers of fruit sorting machinery are likely to innovate and enhance their offerings to cater to this demand, ensuring that their machinery can handle diverse fruit varieties while maintaining quality standards.

Focus on Food Safety and Compliance

The emphasis on food safety and regulatory compliance is increasingly influencing the Fruit Sorting Machinery Market. As governments and organizations implement stricter food safety standards, producers are compelled to adopt sorting technologies that ensure compliance. This focus on safety not only protects consumers but also enhances the reputation of producers in the market. Data shows that investments in sorting machinery that meets safety standards can lead to a 15% reduction in product recalls. Consequently, manufacturers that prioritize compliance in their machinery design are likely to gain a competitive edge, as producers seek to mitigate risks associated with food safety.