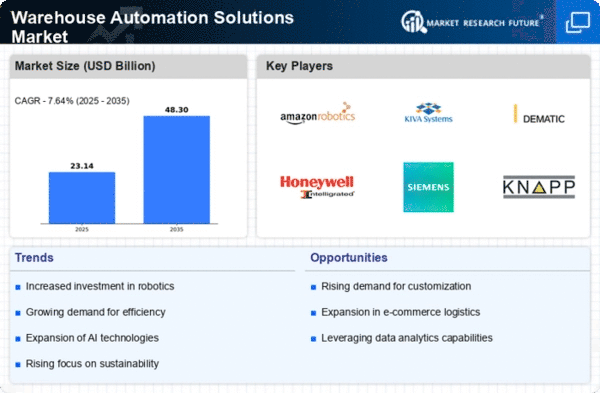

The Warehouse Automation Solutions Market is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for efficiency in logistics. Key players such as Amazon Robotics (US), Dematic (US), and Siemens (DE) are at the forefront, each adopting distinct strategies to enhance their market positioning. Amazon Robotics (US) continues to innovate with its autonomous mobile robots, focusing on improving warehouse efficiency and reducing operational costs. Meanwhile, Dematic (US) emphasizes its integration of AI and machine learning into its automation solutions, aiming to optimize supply chain processes. Siemens (DE) is strategically investing in digital transformation initiatives, enhancing its automation offerings through advanced software solutions, which collectively shape a competitive environment that prioritizes innovation and operational excellence.The business tactics employed by these companies reflect a concerted effort to localize manufacturing and optimize supply chains. The market appears moderately fragmented, with a mix of established players and emerging startups. This structure allows for a diverse range of solutions, catering to various customer needs. The collective influence of key players fosters a competitive atmosphere where technological advancements and customer-centric strategies are paramount.

In November Amazon Robotics (US) announced the launch of its latest generation of autonomous robots, designed to enhance warehouse efficiency by 30%. This strategic move underscores the company's commitment to maintaining its leadership position through continuous innovation. The introduction of these robots is expected to significantly reduce labor costs and improve order fulfillment times, thereby reinforcing Amazon's competitive edge in the market.

In October Dematic (US) unveiled a new AI-driven warehouse management system that integrates seamlessly with existing infrastructure. This development is pivotal as it allows clients to leverage their current investments while enhancing operational capabilities. The system's ability to analyze real-time data and optimize workflows positions Dematic as a key player in the digital transformation of warehouse operations.

In September Siemens (DE) expanded its partnership with a leading logistics provider to implement smart automation solutions across multiple facilities. This collaboration aims to enhance operational efficiency and reduce energy consumption by 20%. Such strategic alliances are indicative of a broader trend towards collaborative innovation, where companies leverage each other's strengths to deliver superior solutions.

As of December the Warehouse Automation Solutions Market is increasingly defined by trends such as digitalization, sustainability, and AI integration. The emphasis on strategic alliances is reshaping the competitive landscape, enabling companies to pool resources and expertise. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize these elements will be better positioned to thrive in an increasingly complex market.