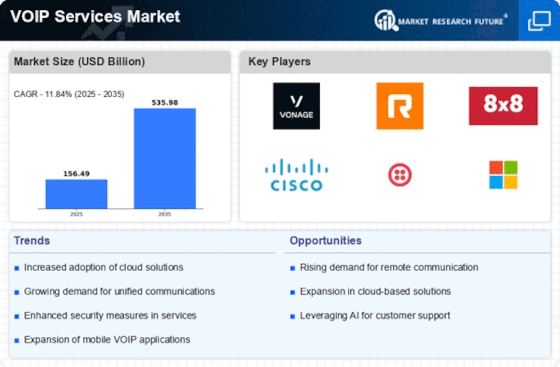

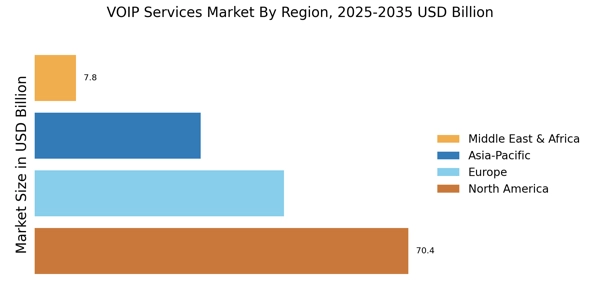

North America : Leading Innovation Hub

North America is the largest market for VOIP services, holding approximately 45% of the global market share. The region's growth is driven by high internet penetration, increasing demand for cost-effective communication solutions, and advancements in cloud technology. Regulatory support, such as the FCC's initiatives to promote broadband access, further catalyzes market expansion. The U.S. remains the primary contributor, followed by Canada, which accounts for about 10% of the market share. The competitive landscape in North America is robust, featuring key players like Vonage, RingCentral, and Cisco. These companies leverage innovative technologies to enhance service offerings, catering to both businesses and individual consumers. The presence of major tech firms, including Microsoft and Twilio, fosters a dynamic environment for VOIP services. As businesses increasingly adopt remote work models, the demand for reliable VOIP solutions continues to surge, solidifying North America's leadership in this sector.

Europe : Emerging Market Dynamics

Europe is witnessing significant growth in the VOIP services market, accounting for approximately 30% of the global share. The region's expansion is fueled by increasing mobile and internet penetration, alongside a shift towards digital communication solutions. Regulatory frameworks, such as the EU's Digital Single Market strategy, promote seamless communication across member states, enhancing market accessibility. Germany and the UK are the largest markets, together representing about 15% of the total market share. Leading countries in Europe include Germany, the UK, and France, with a competitive landscape featuring both established players and emerging startups. Companies like RingCentral and 8x8 are expanding their footprint, while local providers also gain traction. The focus on enhancing user experience and integrating advanced features drives competition, making Europe a vibrant market for VOIP services. The region's commitment to innovation and regulatory support positions it well for future growth.

Asia-Pacific : Rapid Growth Potential

Asia-Pacific is rapidly emerging as a significant player in the VOIP services market, holding around 20% of the global share. The region's growth is driven by increasing smartphone penetration, rising internet usage, and a growing preference for cost-effective communication solutions. Countries like China and India are at the forefront, with substantial investments in telecommunications infrastructure. Regulatory initiatives aimed at enhancing digital connectivity further support market expansion, making it a key area for future growth. China and India are the leading countries in this region, with a competitive landscape that includes both global and local players. Companies like Cisco and Twilio are expanding their services, while local startups are innovating to meet regional demands. The increasing adoption of cloud-based solutions and the rise of remote work culture are propelling the demand for VOIP services, positioning Asia-Pacific as a vital market for future investments and innovations.

Middle East and Africa : Emerging Powerhouse

The Middle East and Africa region is experiencing a burgeoning VOIP services market, accounting for approximately 5% of the global share. The growth is driven by increasing mobile connectivity, a young population eager for digital communication, and investments in telecommunications infrastructure. Countries like South Africa and the UAE are leading the charge, with regulatory frameworks evolving to support VOIP adoption. The region's market is expected to grow significantly as internet access improves and digital services expand. In the competitive landscape, local providers are emerging alongside international players, creating a diverse market environment. South Africa and the UAE are the primary markets, with companies like Ooma and Grasshopper gaining traction. The focus on enhancing service quality and affordability is driving competition, making the Middle East and Africa a promising region for VOIP services. As the demand for reliable communication solutions increases, the market is poised for substantial growth in the coming years.