Increasing Internet Penetration

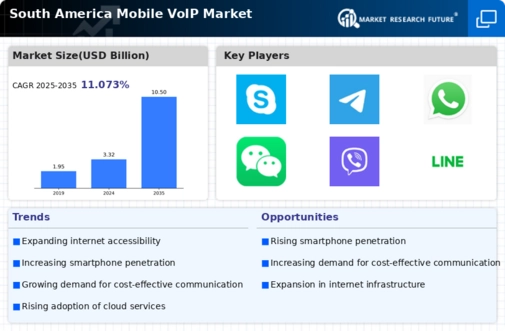

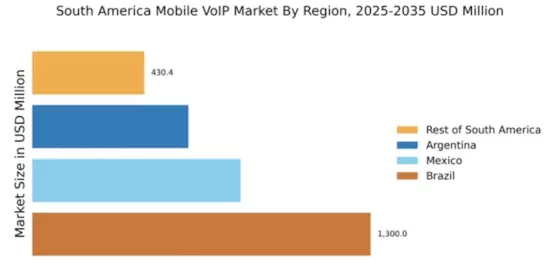

The mobile voip market in South America is experiencing growth due to the increasing penetration of the internet across the region. As of 2025, internet penetration in South America stands at approximately 75%, with countries like Brazil and Argentina leading the way. This widespread access to the internet facilitates the adoption of mobile voip services, as users can easily connect to the internet via their smartphones. The availability of affordable data plans further complements this trend, allowing users to utilize mobile voip applications without incurring significant costs. Consequently, the mobile voip market is likely to see a surge in user adoption, as more individuals gain access to reliable internet services.

Cost-Effectiveness of Communication

Cost-effectiveness is a primary driver for the mobile voip market in South America. Traditional telecommunication services often impose high charges for international calls, which can be a burden for users. In contrast, mobile voip services offer a more economical alternative, allowing users to make calls at a fraction of the cost. For instance, users can save up to 80% on international calls when using mobile voip applications. This financial incentive is particularly appealing in a region where economic disparities exist. As consumers become increasingly aware of the cost benefits associated with mobile voip, the market is expected to expand, attracting both individual users and businesses seeking to reduce communication expenses.

Rising Demand for Remote Work Solutions

The mobile voip market in South America is witnessing a rising demand for remote work solutions. As businesses adapt to flexible work arrangements, the need for efficient communication tools has become paramount. Mobile voip services provide a viable solution, enabling employees to communicate seamlessly from various locations. This trend is particularly pronounced in urban areas where businesses are increasingly adopting digital communication strategies. The mobile voip market is likely to benefit from this shift, as companies seek reliable and cost-effective communication methods to support their remote workforce. Furthermore, the integration of mobile voip with collaboration tools enhances productivity, making it an attractive option for organizations.

Technological Advancements in Mobile Applications

Technological advancements in mobile applications are significantly influencing the mobile voip market in South America. Innovations in app development have led to enhanced features, such as high-definition voice quality and improved user interfaces. These advancements make mobile voip services more appealing to consumers, as they offer a superior communication experience compared to traditional methods. Additionally, the integration of artificial intelligence and machine learning into mobile voip applications is expected to further enhance user experience. As these technologies continue to evolve, the mobile voip market is poised for growth, attracting tech-savvy users who prioritize quality and functionality in their communication tools.

Growing Preference for Unified Communication Solutions

The mobile voip market in South America is benefiting from a growing preference for unified communication solutions. Businesses are increasingly seeking integrated platforms that combine voice, video, and messaging services into a single application. This trend is driven by the desire for streamlined communication and improved collaboration among teams. Mobile voip services that offer these unified solutions are likely to gain traction in the market, as they cater to the evolving needs of businesses. Furthermore, the ability to access these services on mobile devices aligns with the increasing mobility of the workforce, making mobile voip an attractive option for organizations looking to enhance their communication strategies.