Rise of Competitive VR Gaming

The rise of competitive VR gaming is emerging as a notable trend within the Virtual Reality in Gaming Market. Esports events featuring VR games are gaining traction, attracting both players and spectators. As of October 2025, several high-profile tournaments have been established, offering substantial prize pools and sponsorship opportunities. This competitive landscape is likely to enhance the visibility of VR gaming, drawing in new players who are eager to participate in the excitement. The increasing popularity of competitive VR gaming could potentially lead to a more robust market, as it encourages developers to create high-quality, competitive titles that appeal to a wider audience.

Expansion of VR Gaming Platforms

The expansion of VR gaming platforms is a crucial driver for the Virtual Reality in Gaming Industry. Major gaming consoles and PC platforms are increasingly integrating VR capabilities, allowing a wider range of games to be played in virtual reality. As of October 2025, several leading gaming platforms have reported a significant increase in VR-compatible titles, with over 500 new games launched in the past year alone. This expansion not only enhances the variety of available content but also encourages developers to invest in VR game creation. The growing ecosystem of VR platforms is likely to foster a more vibrant gaming community, further stimulating market growth.

Increased Investment in VR Technology

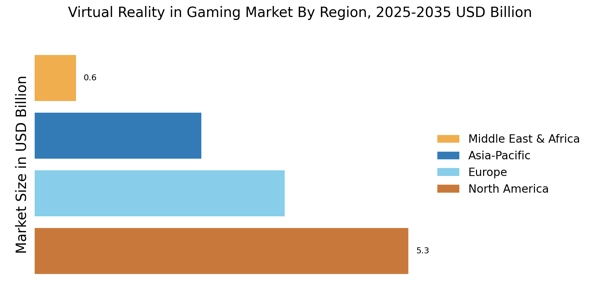

The Virtual Reality in Gaming Market is witnessing a surge in investment from both established gaming companies and new entrants. This influx of capital is primarily directed towards the development of advanced VR hardware and software solutions. As of October 2025, the market is projected to reach a valuation of approximately 30 billion dollars, driven by the demand for immersive gaming experiences. Investors are increasingly recognizing the potential of VR to revolutionize gameplay, leading to innovative titles that leverage cutting-edge technology. This trend suggests that as more resources are allocated to VR development, the quality and variety of gaming experiences will likely improve, attracting a broader audience and enhancing the overall market landscape.

Advancements in VR Hardware and Software

Technological advancements in VR hardware and software are significantly influencing the Virtual Reality in Gaming Market. Innovations such as improved graphics processing units, enhanced motion tracking, and more comfortable headsets are making VR gaming more accessible and enjoyable. As of October 2025, the introduction of standalone VR devices has simplified the user experience, eliminating the need for complex setups. This ease of use is likely to attract new gamers, expanding the market. Furthermore, software improvements, including more sophisticated game engines, are enabling developers to create richer and more complex gaming worlds, which could lead to increased player engagement and retention.

Growing Consumer Demand for Immersive Experiences

Consumer preferences are shifting towards more immersive and engaging gaming experiences, which is a key driver for the Virtual Reality in Gaming Market. Players are increasingly seeking out games that offer realistic environments and interactive gameplay. This demand is reflected in the rising sales of VR headsets, which have seen a year-on-year increase of over 20%. As of October 2025, the number of active VR users is estimated to exceed 50 million, indicating a robust interest in VR gaming. This growing consumer base is likely to encourage developers to create more diverse and innovative VR titles, further propelling the market's expansion.