Technological Integration

The integration of wearable devices with other technologies is a pivotal driver in the Wearable Computing Market. As the Internet of Things (IoT) continues to expand, wearables are increasingly being designed to communicate seamlessly with smartphones, smart home devices, and other connected technologies. This interconnectedness enhances user experience and functionality, allowing for features such as remote health monitoring and smart home automation. Market data indicates that the number of connected wearable devices is expected to reach over 1 billion by 2025, highlighting the growing trend of technological convergence. This integration not only improves the usability of wearable devices but also encourages consumers to adopt them as essential tools in their daily lives, thereby stimulating growth in the Wearable Computing Market.

Rising Adoption in Healthcare

The adoption of wearable technology in the healthcare sector is emerging as a significant driver for the Wearable Computing Market. Healthcare providers are increasingly utilizing wearables for remote patient monitoring, chronic disease management, and post-operative care. This trend is supported by data indicating that the use of wearable devices in healthcare could reduce hospital readmission rates by up to 30%. As healthcare systems seek to improve patient outcomes while reducing costs, the integration of wearables into clinical practices is becoming more prevalent. This shift not only enhances patient engagement but also provides healthcare professionals with valuable data for informed decision-making. Consequently, the Wearable Computing Market is poised for growth as healthcare organizations recognize the potential of wearables to transform patient care.

Health Monitoring Advancements

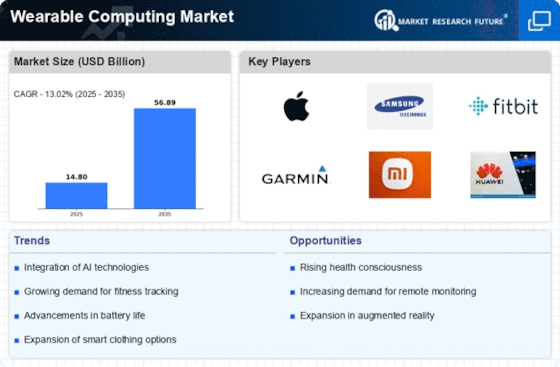

The Wearable Computing Market is experiencing a surge in health monitoring technologies, driven by advancements in sensor technology and data analytics. Devices such as smartwatches and fitness trackers now offer features like heart rate monitoring, sleep tracking, and even blood oxygen level measurement. According to recent data, the health and fitness segment of the wearable market is projected to grow at a compound annual growth rate of over 20% through 2026. This growth is largely attributed to increasing consumer awareness regarding health and wellness, as well as the rising prevalence of chronic diseases. As more individuals seek proactive health management solutions, the demand for innovative wearable devices that provide real-time health insights is likely to escalate, further propelling the Wearable Computing Market.

Consumer Demand for Personalization

The Wearable Computing Market is witnessing a notable shift towards personalization, as consumers increasingly seek devices tailored to their individual needs and preferences. This trend is evident in the growing variety of customizable features available in wearable devices, such as interchangeable bands, personalized health metrics, and adaptive user interfaces. Market Research Future suggests that nearly 60% of consumers are more likely to purchase a wearable device that offers personalized experiences. This demand for customization is driving manufacturers to innovate and differentiate their products, leading to a more competitive landscape. As personalization becomes a key factor in consumer decision-making, the Wearable Computing Market is likely to expand, with brands focusing on creating unique offerings that resonate with diverse consumer segments.

Increased Focus on Fitness and Wellness

The growing emphasis on fitness and wellness is a driving force in the Wearable Computing Market. As individuals become more health-conscious, the demand for devices that facilitate fitness tracking and wellness monitoring is on the rise. Wearable devices are now equipped with advanced features such as GPS tracking, calorie counting, and guided workouts, appealing to fitness enthusiasts and casual users alike. Market analysis reveals that the fitness segment of the wearable market is expected to account for a substantial share, with projections indicating a growth rate of approximately 15% annually. This trend is further fueled by the proliferation of fitness apps and social media platforms that encourage users to share their fitness journeys. As the culture of health and wellness continues to gain traction, the Wearable Computing Market is likely to benefit from increased consumer investment in fitness-oriented wearables.