Research Methodology on Motion Control Market

Introduction

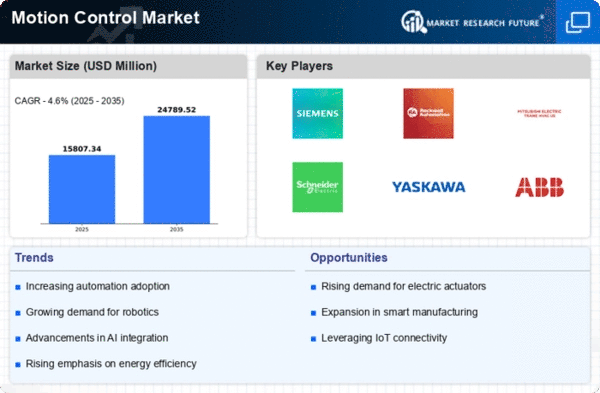

The development of motion control technology enables industrial automation to become faster, more efficient, and more accurate. As motion control technologies become more advanced, more demanding production and manufacturing tasks are now possible. With the drive towards higher levels of manufacturing efficiency and quality, Motion Control Solutions are becoming increasingly popular. The Motion Control Market is expected to grow at a notable rate over the forecast period of 2023-2030.

The main function of motion control is to enable machines to move according to set parameters which in turn enable faster, more efficient, and accurate production. Motion control can be either linear or rotary. Rotary motion control technology allows components to turn around an axis at a constant speed and linear motion control technology allows components to move along a path at a consistent speed. The motion control technology is gaining importance in the world of automation because it enhances the accuracy and efficiency of production processes.

Objectives

The objective of this research is to gain an in-depth understanding of the current Motion Control Market, its size, growth trends, and development landscape. The objectives include:

- Analyzing the size and growth rate of the global Motion Control Market through Porter’s five forces analysis.

- Examining the competitive landscape and major players’ market shares within the Motion Control Market.

- Examining key applications of the Motion Control Market and their impact on the growth of the market.

- Explore the factors influencing the growth of the Motion Control Market over the forecast period of 2023-2030.

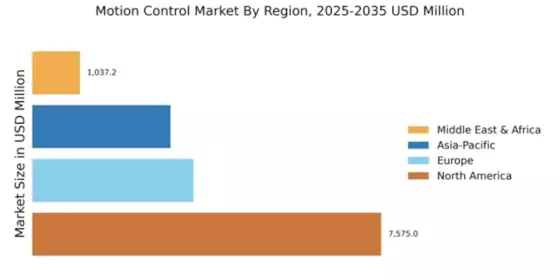

- A geographical analysis of the geography of the Motion Control Market and the impact on the growth of the market.

Research Methodology

The research methodology employed for this report is based on the mixed-method approach which includes qualitative and quantitative research methods. The qualitative method is used to understand the scope of the research and the factors driving the growth of the market and the qualitative method is used to assess the factors restraining and resisting the growth of the market. The collection of data includes primary and secondary sources.

Primary Data:

Primary data is collected through a variety of sources including interviews with key industry personnel, market surveys and focus group discussions. This data is collected through structured interviews, surveys and focus group discussions with target groups of respondents, including industry experts, stakeholders, vendors and distributors.

Secondary Data:

Secondary data is collected from public sources such as the World Bank, International Monetary Fund, and World Trade Organization and other public and private databases such as industry magazines and sector reports.

Data Analysis:

The data collected is analyzed and analysed using various statistical packages such as Excel. The data collected is then processed to obtain meaningful insights and information.

Method of Evaluation

The method of evaluation employed for this report includes Porter’s Five Forces analytic model to assess the competitive environment in the market and the market attractiveness. In addition, the report uses a SWOT analysis to analyse the strengths and weaknesses of the major players in the market.

Data Evaluation and Objectivity

The data collected is evaluated objectively and without bias. The focus of the report is on providing an accurate and objective analysis of the Motion Control Market and the factors driving and restraining its growth.

Conclusion

The research aims to provide an in-depth understanding of the Motion Control Market, its growth trends and its application landscape. The data collected and analyzed for this report is based on the mixed-method approach which includes qualitative and quantitative research methods. The study aims to assess the competitive environment and major players’ market shares within the Motion Control Market. The evaluation of the market is based on Porter’s Five Forces analysis and a SWOT analysis of the major players. The data collected is subjected to objective evaluation and analysis to provide an accurate and unbiased assessment of the Motion Control Market and its growth prospects over the forecast period of 2023-2030.