Research Methodology on the Virtual Clinical Trials Market

Introduction

In recent years, the healthcare industry has witnessed significant changes due to advances in technology, leading to the introduction of virtual clinical trials. Virtual clinical trials are electronic versions of clinical trials which allow data collection and patient follow-up by remote means. This new methodology results in a faster research process, reduced costs and timeline, improved patient compliance, better accuracy of data, and similar outcomes to traditional on-site trials. An in-depth and detailed understanding of the industry provides valuable information to both marketers and prospective investors.

In this research report, Market Research Future (MRFR) has endeavoured to provide an insightful take on the global virtual clinical trials market and its various related aspects. The research report is multi-faceted and considers market trends, in-depth market analysis and forecasts until 2030. The key players, along with their market share, strategies, and regional growth analysis, have also been studied in detail in the report.

Research Methodology

The research methodologies adopted for this research are primary and secondary research, wherein both qualitative and quantitative data were gathered from the entire chain of the virtual clinical trials market to determine the current market scenario, future trends, growth opportunities and limitations.

In the primary research methodology, in-depth expert interviews are conducted, with healthcare experts and other participants at medical facilities such as hospitals and clinical trial centres. During the interviews, information was gathered along with opinions, views and suggestions. In the secondary research, market research reports, accumulated data sets through financial reports, industry magazines and white papers, focus group discussions and other databases were considered.

The secondary source includes Factiva, one source, Bloomberg, Hoovers, Manta and other databases from the private sector and the public sector, CMOS, CBIP, and statistical data from RTIS.

To address the report in a systematic approach, PESTLE tools and Porter’s Five Forces analysis framework were adopted. These tools provide an in-depth analysis of the emerging trends and lucrative opportunities in the market.

Market Segmentation

The virtual clinical trials market is segmented based on product type, end-user, and region.

By product type, the global virtual clinical trials market is segmented into clinical trial software systems, patient engagement systems, and data management systems.

By end user, the global virtual clinical trials market is segmented into pharmaceutical companies, contract research organizations, and research and academic institutes.

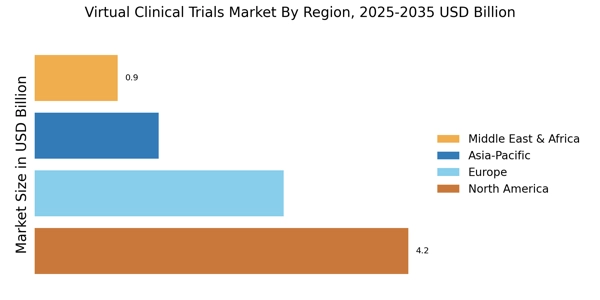

By region, the global virtual clinical trials market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

Market Players

Notable players in the global virtual clinical trials market include Medidata Solutions, Inc. (U.S.), Parexel International Corporation (U.S.), ArunA Biomedical (U.S.), Oracle Corporation (U.S.), Webmedx Inc. (U.S.), ERT Clinical (U.S.), DATATRAK International (U.S.), eClinical Solutions (U.S.), OmniComm Systems, Inc. (U.S.), and Biotrial S.A.S. (France).

Data Collection

To understand and analyze the market, the data collection phase is done. Primary and secondary data is collected by data collection tools such as structured questionnaires, surveys, interviews and focus group discussions. Maynard, Anderson and BCG portfolio analysis techniques are used to identify the categories of virtual clinical trial products and services.

A structured questionnaire survey is conducted with key players and stakeholders in the virtual clinical trials market to collect primary data. For the secondary research, content analysis of various virtual clinical trial market reports was done.

Data Analysis

Data analysis is done to track market trends and performance. This includes the analysis of macro and microeconomic factors, market drivers and restraints, trends and opportunities, and the competitive landscape. The market dynamics analysis is done based on industry trends, drivers and opportunities. Porter’s Five Forces analysis tool is used to understand the industry dynamics and competition among the existing players.

The market size and forecast are conducted by using the top-down and bottom-up approaches. This involves deriving the estimated data from micro and macro factors and further used to validate the market size from primary sources.

Finally, the data is triangulated using data triangulation techniques to get a more accurate and reliable estimate of the market size.

Conclusion

This report is a comprehensive analysis of the global virtual clinical trials market and provides an in-depth understanding of the various factors driving the growth of the industry. The report also contains a detailed analysis of the competitive landscape, key players and their strategies, market segmentation, market dynamics, and forecast until 2030. The report will be valuable to market-oriented investors and stakeholders already in the industry.