Emergence of Personalized Medicine

The emergence of personalized medicine is reshaping the Viral Disease Diagnosis Market by emphasizing tailored treatment approaches based on individual patient profiles. Advances in genomics and biomarker research are enabling healthcare providers to develop more effective diagnostic tests that cater to specific viral infections. This shift towards personalized diagnostics is likely to enhance treatment outcomes and reduce the burden of viral diseases. Market analysts predict that the personalized medicine segment will witness substantial growth, potentially reaching a valuation of several billion dollars within the next decade. As healthcare systems increasingly adopt personalized approaches, the demand for innovative diagnostic solutions is expected to rise, further propelling the market forward.

Rising Awareness of Viral Infections

The rising awareness of viral infections among the general population is significantly influencing the Viral Disease Diagnosis Market. Public health campaigns and educational initiatives are informing individuals about the risks associated with viral diseases, leading to increased demand for diagnostic testing. As awareness grows, more people are seeking testing for viral infections, which in turn drives market growth. Data suggests that the prevalence of viral diseases is prompting healthcare providers to enhance their diagnostic capabilities, resulting in a more proactive approach to viral disease management. This heightened awareness is expected to contribute to a market growth rate of around 12% in the coming years, as individuals prioritize their health and seek timely diagnosis.

Growing Demand for Rapid Diagnostic Tests

The demand for rapid diagnostic tests within the Viral Disease Diagnosis Market is on the rise, driven by the need for quick and reliable results. Healthcare systems are increasingly adopting point-of-care testing (POCT) solutions that provide immediate results, facilitating prompt clinical decision-making. This trend is particularly evident in emergency departments and outpatient settings, where time-sensitive interventions are critical. Market data indicates that the rapid test segment is expected to account for a substantial share of the overall market, with a projected growth rate of approximately 15% annually. The convenience and efficiency of these tests are appealing to both healthcare providers and patients, thereby propelling the market forward.

Increased Investment in Healthcare Infrastructure

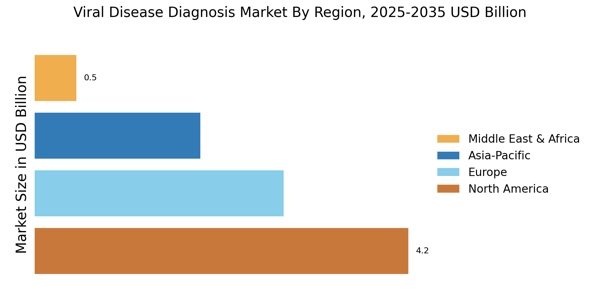

Investment in healthcare infrastructure is a key driver of the Viral Disease Diagnosis Market. Governments and private entities are recognizing the importance of robust healthcare systems capable of addressing viral outbreaks effectively. This has led to increased funding for diagnostic laboratories, research facilities, and healthcare technology. Enhanced infrastructure not only improves access to diagnostic services but also fosters innovation in viral disease detection methods. As countries strive to strengthen their healthcare systems, the market for viral disease diagnostics is likely to expand, with projections indicating a potential increase in market size by 20% over the next five years. This investment is essential for ensuring preparedness against future viral threats.

Technological Innovations in Viral Disease Diagnosis

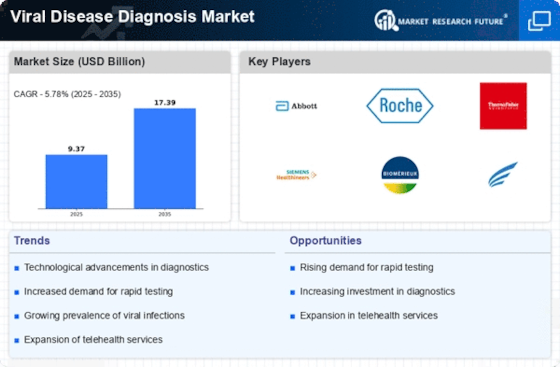

The Viral Disease Diagnosis Market is experiencing a surge in technological innovations that enhance diagnostic accuracy and speed. Advanced molecular techniques, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), are becoming increasingly prevalent. These technologies allow for the rapid identification of viral pathogens, which is crucial for timely treatment and containment. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This growth is driven by the need for more precise and efficient diagnostic tools that can keep pace with emerging viral threats. As healthcare providers seek to improve patient outcomes, the integration of these advanced technologies into routine diagnostics is likely to become a standard practice.