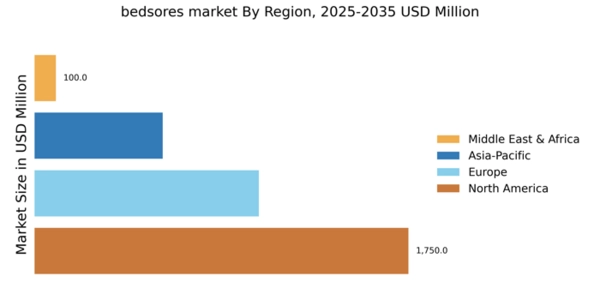

North America : Market Leader in Bedsores Care

North America is projected to maintain its leadership in the bedsores pressure sores market, holding a significant market share of $1750.0M in 2025. The growth is driven by an aging population, increasing prevalence of chronic diseases, and heightened awareness of wound care. Regulatory support from health authorities further catalyzes market expansion, ensuring compliance with safety standards and promoting innovative treatment solutions. The United States stands as the largest contributor, with key players like Smith & Nephew, Hill-Rom Holdings, and 3M Company leading the competitive landscape. The presence of advanced healthcare infrastructure and a focus on research and development bolster the market. Additionally, partnerships and collaborations among manufacturers enhance product offerings, catering to the growing demand for effective wound management solutions.

Europe : Emerging Market with Growth Potential

Europe's bedsores pressure sores market is valued at $1050.0M in 2025, reflecting a robust growth trajectory. Factors such as an increasing elderly population, rising healthcare expenditure, and advancements in medical technology are driving demand. Regulatory frameworks across EU countries are evolving to support innovative wound care solutions, ensuring patient safety and efficacy in treatments. Leading countries like Germany, France, and the UK are at the forefront of this market, with significant contributions from companies such as Mölnlycke Health Care and Convatec Group. The competitive landscape is characterized by a mix of established players and emerging startups, fostering innovation. The European market is poised for growth, supported by favorable regulations and a focus on improving patient outcomes. The European Medicines Agency emphasizes the importance of effective wound management in healthcare.

Asia-Pacific : Rapidly Growing Healthcare Sector

The Asia-Pacific bedsores pressure sores market is projected to reach $600.0M by 2025, driven by increasing healthcare investments and a growing awareness of wound care. The region's expanding elderly population and rising incidence of chronic diseases are significant growth factors. Governments are implementing policies to enhance healthcare access, which is expected to further stimulate market demand. Countries like Japan, China, and Australia are leading the market, with a mix of local and international players such as KCI Medical and Medtronic. The competitive landscape is evolving, with companies focusing on innovative products and solutions tailored to regional needs. Collaborations between healthcare providers and manufacturers are also on the rise, enhancing the availability of advanced wound care products in the region.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa bedsores pressure sores market is valued at $100.0M in 2025, reflecting a nascent but growing sector. The market is driven by increasing healthcare investments and a rising awareness of chronic wound management. However, challenges such as limited healthcare infrastructure and varying regulatory environments can hinder growth. Governments are focusing on improving healthcare access and quality, which is expected to positively impact the market. Countries like South Africa and the UAE are leading the market, with a growing presence of international players. The competitive landscape is characterized by a mix of established companies and new entrants, focusing on innovative solutions to address local needs. The World Health Organization emphasizes the importance of effective wound care in improving health outcomes in the region.