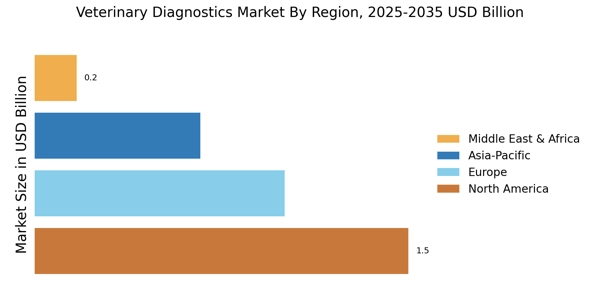

North America : Veterinary Diagnostics Market Leader

North America dominated the global Veterinary Diagnostics Market in 2024, reaching a market size of USD 1.5 billion. The region's growth is driven by increasing pet ownership, advancements in diagnostic technologies, and a strong regulatory framework that supports innovation.

The demand for rapid and accurate diagnostic solutions is rising, fueled by the growing awareness of animal health and welfare. The United States is the primary contributor, with key players like Idexx Laboratories and Zoetis leading the market. The competitive landscape is characterized by continuous innovation and strategic partnerships among major companies. Canada also plays a significant role, contributing to the overall growth with its expanding veterinary services sector.

Europe : Emerging Veterinary Diagnostics Market Hub

Europe is witnessing significant growth in the veterinary diagnostics market, accounting for about 30% of the global share. The region benefits from stringent regulations that ensure high-quality standards in veterinary care, alongside increasing investments in research and development. The rising prevalence of zoonotic diseases and the demand for preventive healthcare are key drivers of market expansion.

Leading countries include Germany, France, and the UK, where major players like Virbac and Boehringer Ingelheim are actively involved. The competitive landscape is marked by collaborations between veterinary clinics and diagnostic companies, enhancing service delivery and innovation. The European market is poised for further growth as awareness of animal health continues to rise.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a rapidly growing market for veterinary diagnostics, holding approximately 20% of the global share. The region's growth is driven by rising disposable incomes, increasing pet ownership, and a growing awareness of animal health. Regulatory support for veterinary practices and diagnostics is also enhancing market dynamics, leading to a surge in demand for advanced diagnostic solutions.

Countries like China, Japan, and India are at the forefront of this growth, with a rising number of veterinary clinics and diagnostic laboratories. Key players such as EIKEN Chemical and Neogen Corporation are expanding their presence in the region, contributing to a competitive landscape that fosters innovation and collaboration among stakeholders.

Middle East and Africa : Emerging Veterinary Market

The Middle East and Africa region is gradually emerging in the veterinary diagnostics market, accounting for about 5% of the global share. The growth is primarily driven by increasing awareness of animal health, rising pet ownership, and the need for effective disease management in livestock. Regulatory frameworks are evolving to support veterinary practices, which is expected to enhance market growth in the coming years.

Countries like South Africa and the UAE are leading the market, with a growing number of veterinary clinics and diagnostic services. The competitive landscape is characterized by the presence of both local and international players, fostering innovation and improving access to veterinary diagnostics. The region is poised for growth as investments in animal health continue to rise.