Rising Demand for Animal Health Products

The Veterinary CRO and CDMO Market is experiencing a notable increase in demand for animal health products. This surge is driven by a growing awareness of animal health and welfare among pet owners and livestock producers. As consumers become more conscious of the quality of animal care, the need for effective veterinary medicines and vaccines intensifies. According to recent data, the animal health market is projected to reach approximately USD 60 billion by 2025, indicating a robust growth trajectory. This demand compels veterinary contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) to enhance their capabilities in developing innovative solutions tailored to the needs of the veterinary sector.

Growing Investment in Veterinary Research

Investment in veterinary research is on the rise, significantly impacting the Veterinary CRO and CDMO Market. Increased funding from both public and private sectors is directed towards the development of new veterinary therapeutics and diagnostics. This influx of capital is essential for fostering innovation and supporting the operational capabilities of CROs and CDMOs. Recent reports indicate that venture capital investments in animal health startups have surged, reflecting a strong belief in the potential of veterinary innovations. Consequently, this trend is likely to stimulate further growth in the market, as more resources become available for research and development initiatives.

Regulatory Support for Veterinary Innovations

The Veterinary CRO and CDMO Market benefits from an evolving regulatory landscape that increasingly supports veterinary innovations. Regulatory bodies are streamlining approval processes for new veterinary drugs and biologics, which encourages investment in research and development. This regulatory facilitation is crucial for CROs and CDMOs, as it allows them to expedite the development timelines of veterinary products. Recent initiatives have been introduced to promote the use of advanced technologies in veterinary medicine, which could potentially lead to a more efficient market. As a result, the collaboration between regulatory agencies and industry stakeholders is likely to foster a more dynamic environment for veterinary product development.

Technological Integration in Veterinary Research

The integration of advanced technologies in veterinary research is a significant driver for the Veterinary CRO and CDMO Market. Innovations such as artificial intelligence, big data analytics, and genomics are transforming the way veterinary research is conducted. These technologies enable more precise and efficient research methodologies, which can lead to faster product development cycles. For instance, the use of AI in drug discovery has shown promise in identifying potential candidates more rapidly than traditional methods. As the industry embraces these technological advancements, CROs and CDMOs are likely to enhance their service offerings, thereby attracting more clients seeking cutting-edge solutions for veterinary product development.

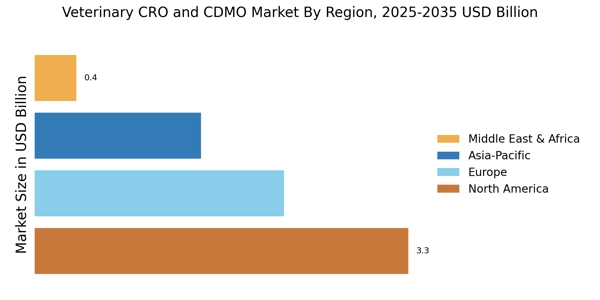

Expansion of Veterinary Services in Emerging Markets

The expansion of veterinary services in emerging markets is a crucial driver for the Veterinary CRO and CDMO Market. As economies develop, there is a corresponding increase in the demand for veterinary care and products. This trend is particularly evident in regions where livestock farming is a primary economic activity. The rising middle class in these areas is also contributing to a greater emphasis on pet care, leading to increased spending on veterinary services. Consequently, CROs and CDMOs are presented with opportunities to establish operations in these markets, catering to the growing needs for veterinary research and product development.