Rising Animal Health Awareness

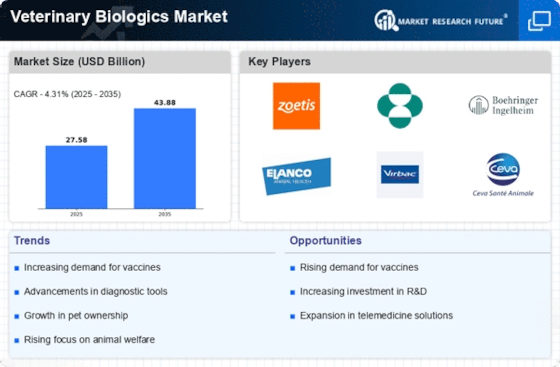

The Veterinary Biologics Market is experiencing a notable surge in demand due to increasing awareness regarding animal health among pet owners and livestock producers. This heightened consciousness is largely driven by the growing recognition of the importance of preventive healthcare measures, including vaccinations and biologics. As a result, the market for veterinary biologics is projected to expand significantly, with estimates suggesting a compound annual growth rate of approximately 7% over the next few years. This trend indicates that stakeholders in the Veterinary Biologics Market must adapt to evolving consumer preferences, focusing on innovative solutions that enhance animal welfare and health outcomes.

Increasing Livestock Production

The demand for veterinary biologics is closely linked to the rising need for livestock production to meet global food demands. As the population continues to grow, the pressure on livestock producers to enhance productivity and ensure animal health intensifies. This trend is driving the Veterinary Biologics Market, as producers increasingly rely on vaccines and biologics to prevent diseases and improve overall herd health. The market is projected to grow at a rate of approximately 5% annually, reflecting the critical role that biologics play in maintaining livestock health and productivity. Consequently, stakeholders must focus on developing biologics that address the specific health challenges faced by livestock.

Regulatory Support for Biologics

The Veterinary Biologics Market is benefiting from a favorable regulatory environment that encourages the development and approval of new biologics. Regulatory agencies are increasingly recognizing the importance of biologics in animal health, leading to streamlined approval processes and guidelines that facilitate market entry. This supportive framework is crucial for fostering innovation and ensuring that veterinarians have access to safe and effective biologics. As a result, the market is expected to witness a steady influx of new products, contributing to an anticipated growth rate of around 6% annually. Stakeholders in the Veterinary Biologics Market must remain vigilant in navigating regulatory changes to capitalize on emerging opportunities.

Advancements in Biologics Technology

Technological innovations are playing a pivotal role in shaping the Veterinary Biologics Market. The development of novel biologics, including vaccines and monoclonal antibodies, is enhancing the efficacy and safety of animal health products. Recent advancements in biotechnology, such as recombinant DNA technology and genomics, are enabling the creation of more targeted and effective biologics. This evolution is expected to drive market growth, with the veterinary biologics segment projected to reach a valuation of over USD 10 billion by 2026. Consequently, companies operating within the Veterinary Biologics Market are likely to invest heavily in research and development to stay competitive and meet the increasing demand for advanced animal health solutions.

Emerging Markets and Veterinary Services

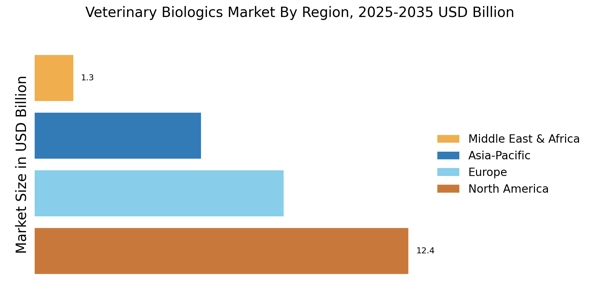

The Veterinary Biologics Market is witnessing growth in emerging markets, where increasing disposable incomes and urbanization are driving demand for veterinary services. As pet ownership rises and livestock farming becomes more commercialized, the need for effective biologics is becoming more pronounced. This trend is expected to result in a market expansion of around 8% in these regions, as stakeholders seek to provide comprehensive health solutions for animals. Companies in the Veterinary Biologics Market should consider tailoring their products and services to meet the unique needs of these emerging markets, ensuring that they remain competitive in a rapidly evolving landscape.