Regulatory Compliance

The Global Biologics Safety Testing Market Industry is driven by stringent regulatory requirements imposed by health authorities worldwide. Regulatory bodies such as the FDA and EMA mandate rigorous testing protocols to ensure the safety and efficacy of biologics. Compliance with these regulations is essential for market entry and product approval, thereby propelling the demand for safety testing services. As the industry evolves, the need for updated testing methodologies to meet regulatory standards becomes increasingly critical. This compliance landscape is expected to shape the market dynamics significantly, as companies invest in advanced testing solutions to adhere to these regulations.

Emerging Markets Growth

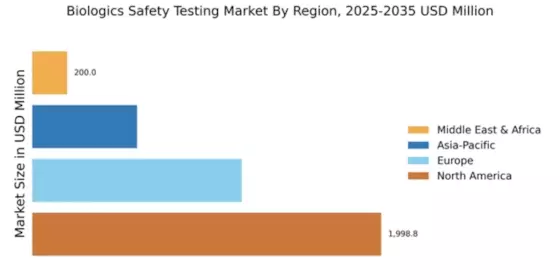

The expansion of emerging markets presents a significant opportunity for the Global Biologics Safety Testing Market Industry. Countries in Asia-Pacific, Latin America, and Africa are witnessing increased investments in healthcare infrastructure and biologics manufacturing. As these regions develop their capabilities, the demand for safety testing services is likely to rise. The growth of local biologics production facilities necessitates adherence to international safety standards, thereby driving the need for comprehensive testing solutions. This trend is expected to contribute to the overall market growth, as emerging economies seek to enhance their healthcare systems and ensure the safety of biologics.

Global Health Initiatives

Global health initiatives aimed at improving healthcare access and outcomes are driving the Global Biologics Safety Testing Market Industry. Organizations such as the WHO and various governmental agencies are investing in biologics research and development to address pressing health challenges. These initiatives often emphasize the importance of safety testing to ensure that biologics are safe for public use. As governments and international bodies allocate resources to enhance healthcare systems, the demand for reliable safety testing services is likely to increase. This growing focus on health equity and safety is expected to shape the market landscape in the coming years.

Technological Advancements

Technological innovations play a pivotal role in the Global Biologics Safety Testing Market Industry, enhancing the efficiency and accuracy of testing processes. The integration of automation, high-throughput screening, and advanced analytical techniques allows for faster and more reliable results. For instance, the adoption of next-generation sequencing technologies has revolutionized the detection of contaminants in biologics. As these technologies continue to evolve, they are likely to drive market growth by enabling laboratories to conduct comprehensive safety assessments more effectively. The ongoing investment in research and development further underscores the importance of technology in shaping the future of biologics safety testing.

Increasing Biologics Production

The rising production of biologics, including monoclonal antibodies and vaccines, significantly influences the Global Biologics Safety Testing Market Industry. With the market projected to reach 4 USD Billion in 2024, the demand for safety testing services is expected to increase correspondingly. As manufacturers scale up production to meet global healthcare needs, the necessity for robust safety testing protocols becomes paramount. This trend is anticipated to persist, with the market maintaining a steady trajectory towards 4 USD Billion by 2035. The continuous expansion of biologics production facilities worldwide further emphasizes the critical role of safety testing in ensuring product integrity and patient safety.