North America : Market Leader in VC & PE

North America continues to lead the Venture Capital and Private Equity Consulting Services market, holding a significant share of 30.8% as of 2024. The region's growth is driven by a robust startup ecosystem, increased investment in technology, and favorable regulatory frameworks that encourage innovation. Additionally, the presence of major financial institutions and venture capital firms fuels demand for consulting services, enhancing market dynamics.

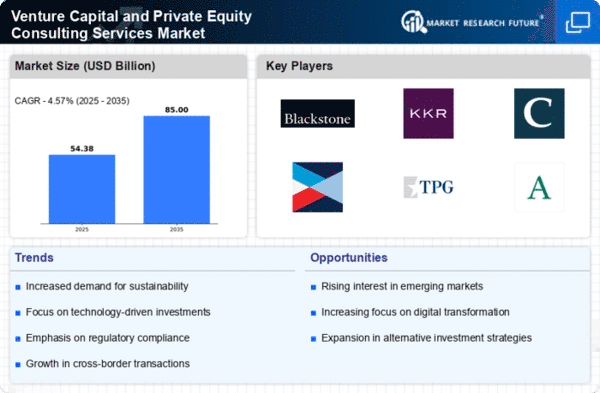

The competitive landscape is characterized by key players such as Blackstone Group, KKR, and Carlyle Group, which dominate the market. The United States, particularly Silicon Valley, remains a hub for venture capital activity, attracting global investors. The concentration of wealth and expertise in this region fosters a vibrant environment for private equity, making it a focal point for consulting services in the sector.

Europe : Emerging Market with Potential

Europe's Venture Capital and Private Equity Consulting Services market is on the rise, with a market share of 10.4% as of 2024. The region benefits from increasing government support for startups, innovative funding mechanisms, and a growing interest in sustainable investments. Regulatory initiatives aimed at enhancing transparency and investor protection are also contributing to market growth, creating a favorable environment for consulting services.

Leading countries such as the UK, Germany, and France are at the forefront of this growth, with a burgeoning number of startups and venture capital firms. The competitive landscape features both established players and emerging firms, fostering innovation and collaboration. The presence of key players like Bain Capital and TPG Capital further strengthens the market, positioning Europe as a significant player in the global VC landscape.

Asia-Pacific : Rapid Growth and Investment

The Asia-Pacific region is witnessing a rapid expansion in the Venture Capital and Private Equity Consulting Services market, holding a market share of 8.4% as of 2024. This growth is fueled by increasing digital transformation, a rise in entrepreneurial ventures, and supportive government policies aimed at fostering innovation. The region's diverse economies and large consumer base present significant opportunities for investment and consulting services, driving demand in the sector.

Countries like China, India, and Australia are leading the charge, with a growing number of startups attracting substantial venture capital. The competitive landscape is vibrant, featuring both local and international players. Key firms are increasingly focusing on technology-driven solutions, enhancing their service offerings to meet the evolving needs of clients in this dynamic market.

Middle East and Africa : Emerging Opportunities in VC

The Middle East and Africa (MEA) region is gradually emerging in the Venture Capital and Private Equity Consulting Services market, with a market share of 2.4% as of 2024. The growth is driven by increasing investment in technology and infrastructure, alongside government initiatives aimed at diversifying economies. The region's young population and rising entrepreneurial spirit are also contributing to the demand for consulting services, creating new opportunities for growth.

Countries like the UAE and South Africa are leading the way, with a growing number of venture capital firms and startups. The competitive landscape is evolving, with both local and international players entering the market. The presence of key players is still developing, but the potential for growth in this region is significant, making it an attractive area for investment and consulting services.