Increased Regulatory Support

The Private Equity Market benefits from a favorable regulatory environment that encourages investment. Governments are increasingly recognizing the role of private equity in driving economic growth and job creation. Recent policy initiatives have aimed to streamline the investment process and reduce barriers for private equity firms. For instance, tax incentives for private equity investments have been introduced in several jurisdictions, which may enhance the attractiveness of this asset class. Furthermore, regulatory bodies are working to improve transparency and governance standards within the industry, which could bolster investor confidence. As a result, the private equity market is likely to experience enhanced participation from both domestic and international investors.

Expansion of Fundraising Channels

The Private Equity Market is experiencing an expansion of fundraising channels, which is facilitating greater access to capital. Traditional fundraising methods, such as limited partnerships, are being complemented by innovative approaches, including crowdfunding and online platforms. In 2025, it is estimated that alternative fundraising methods could account for up to 20% of total private equity capital raised. This diversification of fundraising channels is enabling private equity firms to tap into a wider investor base, including retail investors who were previously excluded from this asset class. As these new channels gain traction, the private equity market may see an influx of capital, further fueling investment opportunities and growth.

Growing Interest in Impact Investing

The Private Equity Market is witnessing a growing interest in impact investing, where investors seek to generate social and environmental benefits alongside financial returns. This trend is particularly pronounced among millennial and Gen Z investors, who prioritize sustainability and ethical considerations in their investment choices. In 2025, impact-focused private equity funds are projected to account for a significant portion of total private equity assets under management. This shift is prompting private equity firms to develop strategies that align with environmental, social, and governance (ESG) criteria, thereby attracting a broader base of investors. As the demand for impact investments continues to rise, the private equity market is likely to adapt and innovate to meet these evolving expectations.

Rising Demand for Alternative Investments

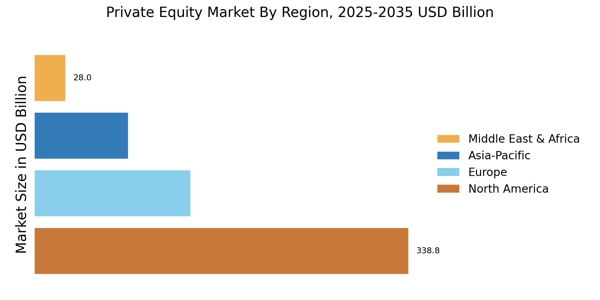

The Private Equity Market is experiencing a notable increase in demand for alternative investments. Investors are increasingly seeking diversification beyond traditional asset classes, which has led to a surge in capital allocation towards private equity. In 2025, private equity fundraising reached approximately 500 billion USD, reflecting a robust appetite for investment opportunities. This trend is driven by the potential for higher returns compared to public markets, as well as the ability to invest in innovative companies that may not yet be publicly traded. As institutional investors, such as pension funds and endowments, continue to allocate a larger portion of their portfolios to private equity, the industry is likely to see sustained growth in both fundraising and investment activity.

Technological Advancements in Investment Strategies

Technological advancements are reshaping the Private Equity Market by enabling more sophisticated investment strategies. The integration of data analytics, artificial intelligence, and machine learning is allowing private equity firms to identify investment opportunities with greater precision. In 2025, it is estimated that over 60% of private equity firms are utilizing advanced analytics to inform their investment decisions. This trend not only enhances the efficiency of deal sourcing but also improves portfolio management and value creation strategies. As technology continues to evolve, private equity firms that leverage these tools may gain a competitive edge, potentially leading to higher returns for investors.