Research Methodology on Utility Aircraft Market

Introduction

The objective of this research is to provide an exhaustive analysis of the utility aircraft market and the factors influencing it. To arrive at informed estimates and identify new trends, the research has adopted an extensive primary and secondary research approach. A qualitative analysis is conducted to understand the economic, political, technological, and social frameworks of the market.

Research Objectives

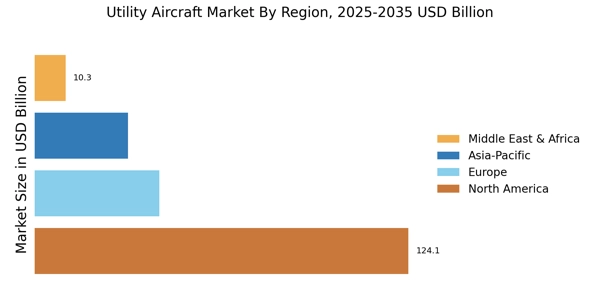

The primary objective is to determine the size and value of the utility aircraft market globally. The research also aims to identify and profile the leading players in the market, determine the geographical presence of utility aircraft manufacturers, and assess the global utility aircraft industry in terms of project development and utilization. The research further aims to understand the factors that influence market dynamics, and the competitive landscape of the global utility aircraft market and determine the market trends, economic, political, and technological trends, and other restraints.

Research Design

This study follows the Market Research Future Research Design Methodology (MRFR) which uses a combination of primary and secondary research and qualitative and quantitative analysis. The approach adopted is bottom-up and top-down processes to arrive at reliable market size, share, and value estimations.

Secondary Research

This research is based on data gathered from various secondary sources such as white papers, directories, reports from databases & websites, investor presentations, industry magazines, annual reports, books, and e-journals. The information gathered helps in comprehending the market patterns, drivers, trends, challenges, and restraints.

Primary Research

The primary research conducted and carried out involved interviewing and surveying leading utility aircraft industry players, market players, market analysts, and thought leaders to gain a deep understanding of the market dynamics, revenue details, and trends.

Factors Analysis

This research method assesses the factors affecting the growth of the utility aircraft market through factor analysis. Point-wise analysis is done to understand the global business environment, regional trends, and social and political factors. These provide insights that allow the marketer to develop actionable plans based on sound timing and rationalizing.

Time-Series Analysis

Time-series analysis is used to analyze past data using regression methods to assess future trends, competitive environment, and technology directions. The analysis helps in determining the value of the opportunity by forecasting the market growth rate, market share, geographical presence, market-entry, strategy formulation, and launching of products.

Demand Side and Supply Side Data Triangulation

The demand and supply side data triangulation is used to validate the current size and value of the utility aircraft market. This methodology captures the supply side of the utility aircraft market, enabling us to analyze the cost of production, production techniques, current investments in the market, and other factors. This comparison helps us to identify the value of the opportunity for the utility aircraft market.

Expert Validation

The research is further validated by the expert opinions of the industry and market players, consultants, market analysts, industrialists, and industry associations. These insights help in confirming the facts and figures validated from other sources.

Conclusion

The extensive research methodology employed in this research is designed to provide an unbiased, dependable and accurate understanding of the utility aircraft market. The results achieved through our research will enable the manufacturer, distributors, and service providers to identify key areas of growth and strategic opportunities for the market.