Focus on Cybersecurity Measures

In the context of the US Aircraft Computers Market, the emphasis on cybersecurity measures has become increasingly critical. With the rise of digital systems in aviation, the potential for cyber threats poses significant risks to aircraft safety and operational integrity. The Federal Aviation Administration (FAA) has implemented stringent regulations to ensure that aircraft systems are resilient against cyber attacks. As a result, manufacturers are investing heavily in developing secure aircraft computers that can withstand potential breaches. This focus on cybersecurity is expected to drive innovation and growth within the market, as stakeholders prioritize the protection of sensitive data and operational systems. The market for cybersecurity solutions in aviation is anticipated to expand, further influencing the US Aircraft Computers Market.

Regulatory Compliance and Standards

Regulatory compliance and adherence to industry standards are fundamental drivers in the US Aircraft Computers Market. The FAA and other regulatory bodies impose strict guidelines to ensure the safety and reliability of aircraft systems. Compliance with these regulations necessitates the development of advanced aircraft computers that meet specific performance and safety criteria. As manufacturers strive to align their products with evolving regulations, there is a growing demand for innovative solutions that can facilitate compliance. This driver not only influences product development but also shapes market dynamics, as companies that can effectively navigate regulatory challenges are likely to gain a competitive edge in the US Aircraft Computers Market.

Increased Demand for Advanced Avionics

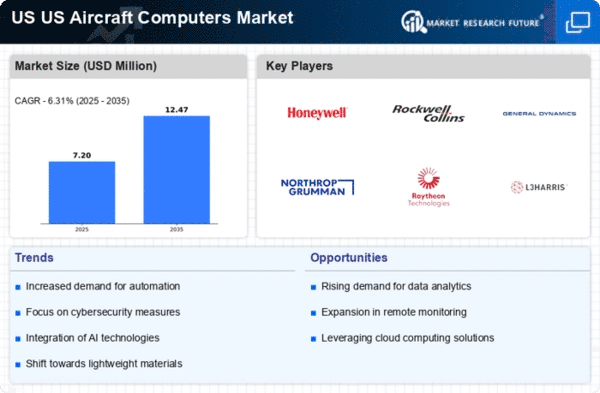

The US Aircraft Computers Market is currently experiencing a surge in demand for advanced avionics systems. This trend is driven by the need for enhanced safety, efficiency, and operational capabilities in modern aircraft. According to recent data, the avionics market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% through 2026. This growth is attributed to the increasing adoption of digital technologies and the integration of sophisticated navigation and communication systems. As airlines and manufacturers prioritize upgrading their fleets, the demand for advanced aircraft computers that support these avionics systems is likely to rise significantly. Consequently, this driver is pivotal in shaping the future landscape of the US Aircraft Computers Market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into aircraft systems is emerging as a transformative driver within the US Aircraft Computers Market. AI technologies are being utilized to enhance decision-making processes, improve predictive maintenance, and optimize flight operations. The incorporation of AI algorithms into aircraft computers allows for real-time data analysis, leading to increased efficiency and reduced operational costs. As airlines seek to leverage AI for competitive advantage, the demand for advanced aircraft computers capable of supporting these technologies is likely to grow. Market Research Future suggest that the AI market in aviation could reach USD 3 billion by 2027, indicating a substantial opportunity for growth within the US Aircraft Computers Market.

Growing Investment in Research and Development

The US Aircraft Computers Market is witnessing a notable increase in investment in research and development (R&D) activities. This trend is driven by the need for continuous innovation and the development of next-generation aircraft systems. Companies are allocating substantial resources to R&D to enhance the capabilities of aircraft computers, focusing on areas such as automation, connectivity, and data analytics. The US government has also recognized the importance of R&D in aviation, providing funding and support for initiatives aimed at advancing technology in the sector. As a result, the growing investment in R&D is expected to propel advancements in the US Aircraft Computers Market, fostering a competitive environment that encourages innovation and technological progress.