Cost Efficiency

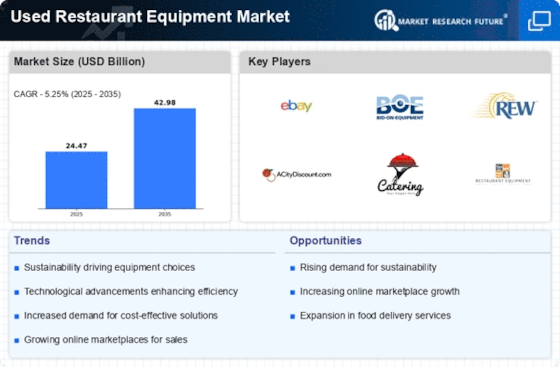

The used restaurant equipment Market is driven by the increasing need for cost efficiency among restaurant operators. As new equipment can be prohibitively expensive, many establishments opt for used equipment to reduce initial capital expenditures. This trend is particularly pronounced among small to medium-sized enterprises, which often operate on tighter budgets. According to recent data, the used equipment segment has seen a growth rate of approximately 5% annually, as more businesses recognize the financial benefits of purchasing pre-owned items. Additionally, the availability of refurbished equipment, which meets industry standards, further enhances the appeal of this market. By investing in used equipment, restaurants can allocate resources more effectively, allowing for better cash flow management and the potential for reinvestment in other areas of their operations.

E-commerce Expansion

The Used Restaurant Equipment Market is significantly impacted by the expansion of e-commerce platforms. The rise of online marketplaces has made it easier for restaurant operators to access a wide range of used equipment options. This shift has democratized the purchasing process, allowing smaller establishments to compete with larger chains by sourcing affordable equipment online. Recent statistics indicate that e-commerce sales in the used equipment sector have increased by approximately 10% over the past year. This trend is expected to continue as more businesses recognize the convenience and cost-effectiveness of online purchasing. Additionally, the ability to compare prices and read reviews enhances consumer confidence, further driving sales in the used equipment market. As e-commerce continues to evolve, it is likely that the used restaurant equipment sector will adapt, leading to increased accessibility and a broader customer base.

Regulatory Compliance

The Used Restaurant Equipment Market is influenced by the need for regulatory compliance. As health and safety standards become more stringent, restaurant operators are compelled to ensure that their equipment meets specific regulations. This has led to an increased demand for used equipment that has been certified or refurbished to comply with industry standards. Data suggests that establishments that prioritize compliance are more likely to avoid costly fines and operational disruptions. Furthermore, the trend towards regulatory compliance is expected to drive growth in the used equipment market, as operators seek reliable sources for compliant products. This focus on adherence to regulations not only protects businesses from legal repercussions but also enhances customer trust, which is vital in the competitive food service industry. As regulations evolve, the used restaurant equipment market is likely to adapt, ensuring that operators have access to compliant solutions.

Technological Integration

The Used Restaurant Equipment Market is experiencing a shift due to technological integration. As restaurants adopt advanced technologies, there is a growing demand for equipment that can seamlessly integrate with these innovations. Used equipment that incorporates smart technology features, such as energy-efficient appliances and IoT connectivity, is becoming increasingly sought after. This trend is particularly relevant as operators look to enhance operational efficiency and reduce energy costs. Market data indicates that the demand for technologically advanced used equipment is rising, with a projected increase of 7% in the next few years. This integration not only improves the functionality of existing equipment but also allows restaurants to stay competitive in a rapidly evolving market. As a result, the used equipment sector is likely to see continued growth as operators seek to balance cost savings with technological advancements.

Sustainability Initiatives

The Used Restaurant Equipment Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, many restaurants are seeking ways to minimize their carbon footprint. Purchasing used equipment is viewed as a sustainable practice, as it extends the lifecycle of existing products and reduces waste. This trend aligns with the broader movement towards eco-friendly practices within the food service sector. Data suggests that establishments that prioritize sustainability are more likely to attract environmentally conscious consumers, thereby enhancing their market position. Furthermore, the used equipment market is expected to benefit from the growing emphasis on sustainable sourcing, as operators look to align their purchasing decisions with their corporate social responsibility goals. This shift not only supports environmental sustainability but also fosters a positive brand image, which is increasingly important in today's competitive landscape.