Rising Labor Costs

The US Restaurant Delivery Robot Market is being driven by the rising labor costs that many restaurants are currently facing. As wages increase and labor shortages persist, restaurant operators are seeking alternative solutions to maintain profitability. Delivery robots present a viable option to mitigate these challenges by reducing the reliance on human labor for delivery tasks. Data suggests that labor costs can account for up to 30% of a restaurant's operating expenses, making automation an attractive proposition. By investing in delivery robots, restaurants can streamline their operations and allocate resources more effectively, ultimately enhancing their bottom line. This trend is likely to continue as labor market conditions evolve.

Regulatory Developments

The US Restaurant Delivery Robot Market is also shaped by evolving regulatory developments that govern the use of delivery robots. Various states and municipalities are establishing guidelines to ensure the safe operation of these devices on public roads and sidewalks. For example, some jurisdictions have implemented specific speed limits and operational zones for delivery robots, which can impact their deployment strategies. As regulations become more standardized, it is likely that the market will see increased investment from restaurant operators looking to adopt this technology. Furthermore, favorable regulations may encourage innovation and collaboration between tech companies and restaurants, potentially leading to a more robust market environment.

Technological Advancements

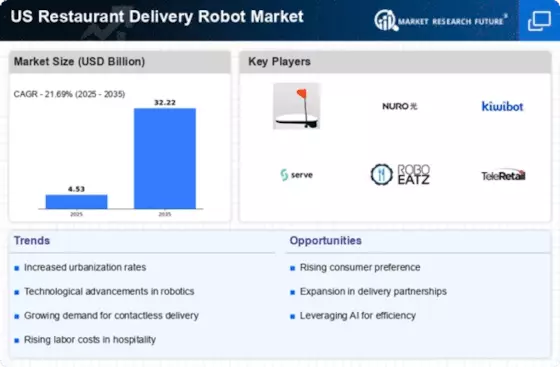

The US Restaurant Delivery Robot Market is experiencing rapid technological advancements that enhance the efficiency and functionality of delivery robots. Innovations in artificial intelligence, machine learning, and robotics are enabling these devices to navigate complex environments, avoid obstacles, and optimize delivery routes. For instance, companies are integrating advanced sensors and cameras that allow robots to operate in various weather conditions and terrains. According to recent data, the market for delivery robots is projected to grow at a compound annual growth rate of over 20% through 2028, driven by these technological improvements. As restaurants adopt these technologies, they can reduce labor costs and improve service speed, thereby increasing customer satisfaction and loyalty.

Consumer Demand for Convenience

The US Restaurant Delivery Robot Market is significantly influenced by the growing consumer demand for convenience. As lifestyles become increasingly fast-paced, customers are seeking quicker and more efficient ways to receive their food. Delivery robots offer a unique solution by providing contactless delivery options that align with consumer preferences for safety and convenience. Recent surveys indicate that over 60% of consumers are willing to try robotic delivery services, reflecting a shift in dining habits. This trend is particularly pronounced among younger demographics, who are more inclined to embrace technology. As restaurants respond to this demand by integrating delivery robots into their operations, they can enhance their competitive edge and attract a broader customer base.

Increased Investment in Automation

The US Restaurant Delivery Robot Market is witnessing increased investment in automation technologies as businesses recognize the potential benefits of robotic delivery systems. Venture capital funding for robotics startups has surged, with many investors seeing the long-term value in automating food delivery. This influx of capital is enabling companies to accelerate research and development efforts, leading to more sophisticated and reliable delivery robots. As automation becomes more prevalent in the restaurant sector, it is expected that operational efficiencies will improve, resulting in cost savings and enhanced customer experiences. The trend of investing in automation is likely to reshape the competitive landscape of the restaurant industry.