Advancements in Telematics Technology

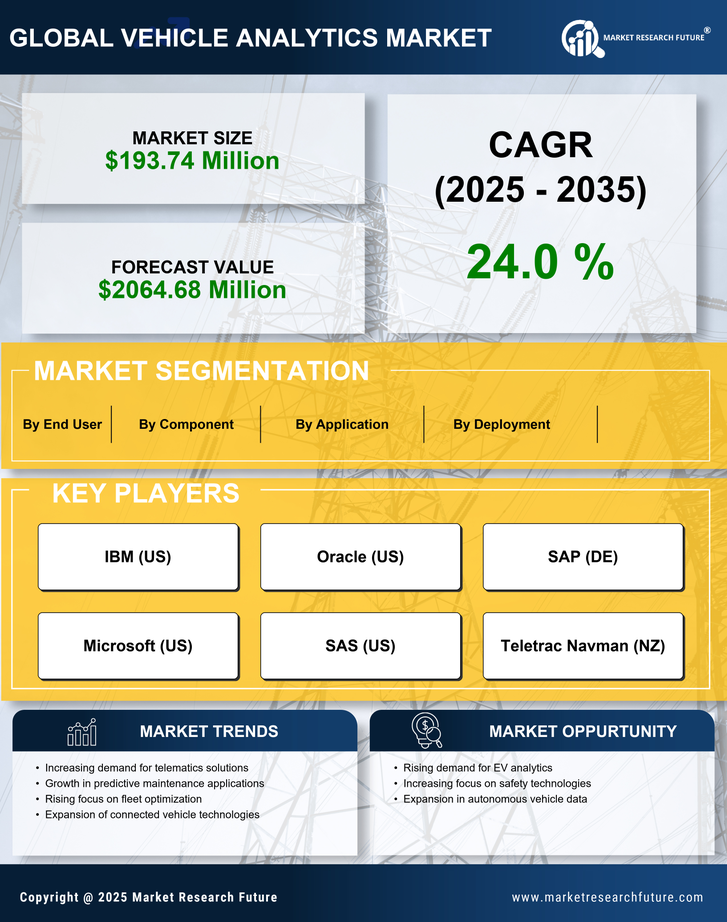

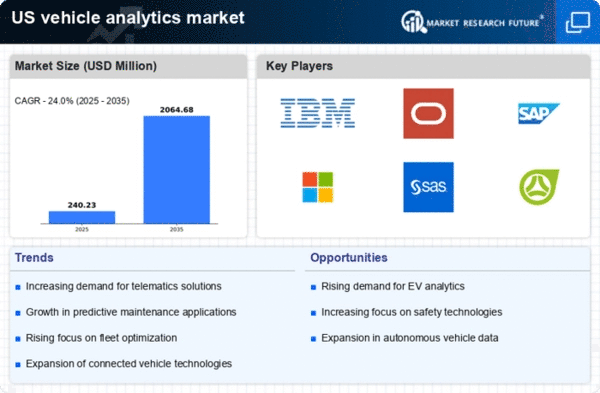

Telematics technology is evolving rapidly, significantly impacting the vehicle analytics market. The integration of GPS, onboard diagnostics, and real-time data transmission enables businesses to gather comprehensive insights into vehicle performance and driver behavior. In 2025, the telematics market is expected to exceed $20 billion in the US, reflecting a growing reliance on data for operational efficiency. Companies are utilizing telematics to enhance route optimization, reduce maintenance costs, and improve overall fleet safety. This technological advancement not only streamlines operations but also fosters a culture of accountability among drivers. As telematics continues to advance, it is likely to play a pivotal role in shaping the future of the vehicle analytics market.

Growing Demand for Fleet Management Solutions

The vehicle analytics market is experiencing a notable surge in demand for fleet management solutions. Companies are increasingly recognizing the value of data-driven insights to optimize their operations. In 2025, the fleet management sector is projected to reach approximately $30 billion in the US, driven by the need for improved efficiency and cost reduction. Fleet operators are leveraging vehicle analytics to monitor vehicle performance, track fuel consumption, and enhance driver safety. This trend indicates a shift towards more sustainable practices, as businesses aim to reduce their carbon footprint while maximizing productivity. The integration of advanced analytics tools allows fleet managers to make informed decisions, ultimately contributing to the growth of the vehicle analytics market.

Increased Focus on Sustainability Initiatives

The vehicle analytics market is witnessing a heightened emphasis on sustainability initiatives among businesses. As environmental concerns gain traction, companies are increasingly adopting analytics solutions to monitor and reduce their carbon emissions. In 2025, it is estimated that around 70% of organizations in the transportation sector will implement sustainability measures, driving demand for vehicle analytics tools. These tools enable businesses to analyze fuel consumption patterns, identify inefficiencies, and implement eco-friendly practices. By leveraging data analytics, organizations can not only comply with regulatory standards but also enhance their brand reputation. This growing focus on sustainability is likely to propel the vehicle analytics market forward, as companies seek to align their operations with environmentally responsible practices.

Integration of Connected Vehicle Technologies

The integration of connected vehicle technologies is reshaping the landscape of the vehicle analytics market. As vehicles become increasingly connected, the volume of data generated is expanding exponentially. In 2025, the connected vehicle market is anticipated to surpass $50 billion in the US, driven by advancements in Internet of Things (IoT) technologies. This connectivity allows for real-time data collection and analysis, enabling businesses to gain valuable insights into vehicle performance and user behavior. Companies are leveraging this data to enhance customer experiences, optimize maintenance schedules, and improve overall operational efficiency. The proliferation of connected vehicle technologies is likely to be a key driver in the growth of the vehicle analytics market, as organizations seek to harness the power of data to stay competitive.

Rising Consumer Expectations for Safety Features

Consumer expectations regarding vehicle safety are on the rise, influencing the vehicle analytics market. As safety becomes a paramount concern, manufacturers and fleet operators are increasingly utilizing analytics to enhance safety features in vehicles. In 2025, it is projected that the market for advanced driver-assistance systems (ADAS) will reach $15 billion in the US, reflecting a growing investment in safety technologies. Vehicle analytics plays a crucial role in monitoring driver behavior, identifying risky patterns, and providing actionable insights to improve safety. This trend indicates a shift towards a more proactive approach to vehicle safety, as organizations aim to reduce accidents and enhance overall road safety. Consequently, the demand for vehicle analytics solutions is likely to grow in tandem with these rising consumer expectations.