Emphasis on Operational Efficiency

In the current business landscape, operational efficiency has emerged as a critical focus for organizations across various sectors. The system monitoring market is responding to this emphasis by providing tools that enhance productivity and streamline processes. Companies are increasingly adopting monitoring solutions that facilitate the identification of bottlenecks and inefficiencies within their systems. By leveraging data analytics, organizations can optimize resource allocation and improve overall performance. Recent studies suggest that businesses utilizing effective monitoring tools can achieve up to a 20% reduction in operational costs. This drive towards efficiency is likely to propel the system monitoring market forward, as organizations seek to maximize their return on investment.

Growing Complexity of IT Environments

As organizations expand their digital footprints, the complexity of IT environments continues to escalate. This complexity necessitates sophisticated monitoring solutions capable of managing diverse systems, applications, and networks. the system monitoring market adapts to this challenge by offering integrated solutions that provide comprehensive visibility across multi-cloud and hybrid environments.. The increasing number of devices and applications connected to networks further complicates monitoring efforts. Consequently, businesses are prioritizing investments in advanced monitoring tools that can seamlessly integrate with existing infrastructure. This trend indicates a robust growth trajectory for the system monitoring market, as organizations strive to maintain optimal performance amidst rising complexity.

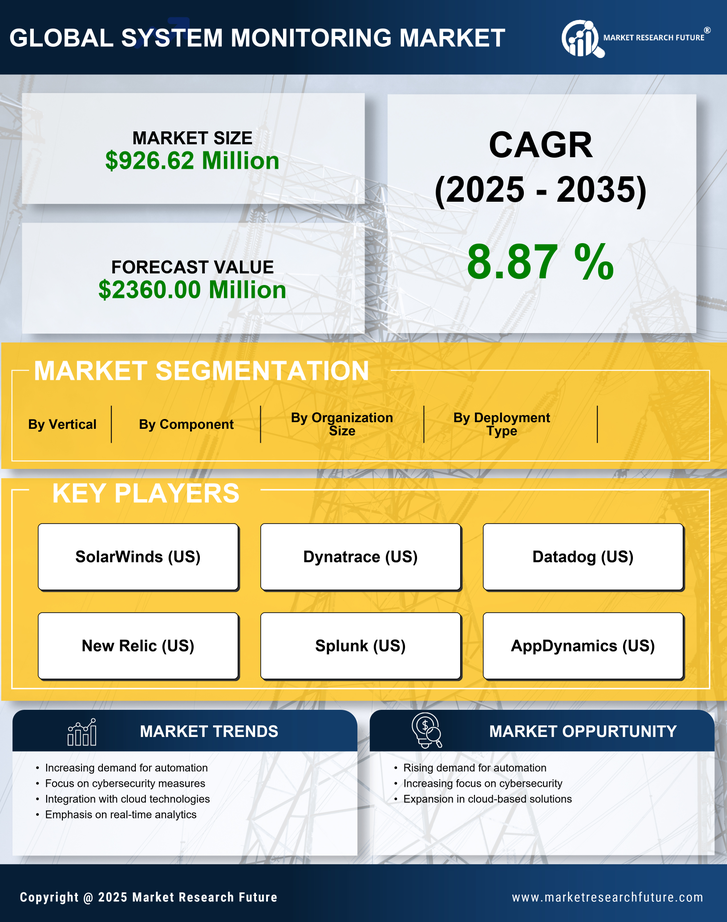

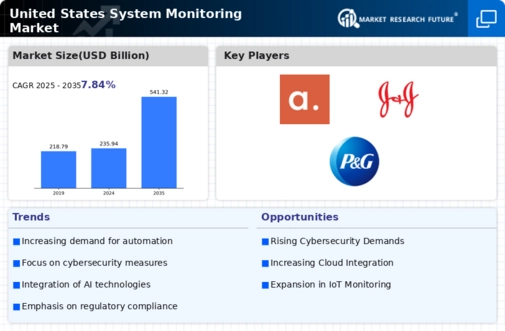

Rising Demand for Real-Time Monitoring

The system monitoring market experiences a notable surge in demand for real-time monitoring solutions. Organizations increasingly recognize the necessity of immediate insights into system performance and health. This trend is driven by the need to enhance operational efficiency and minimize downtime. According to recent data, the market for real-time monitoring solutions is projected to grow at a CAGR of approximately 12% over the next five years. Companies are investing in advanced monitoring tools that provide instant alerts and analytics, enabling proactive management of IT infrastructure. This shift towards real-time capabilities is reshaping the system monitoring market, as businesses seek to leverage data for informed decision-making and improved service delivery.

Advancements in Technology and Innovation

Technological advancements are playing a pivotal role in shaping the system monitoring market. Innovations in areas such as artificial intelligence, machine learning, and big data analytics are enhancing the capabilities of monitoring solutions. These technologies enable organizations to gain deeper insights into system performance and predict potential issues before they escalate. The integration of AI-driven analytics into monitoring tools is particularly noteworthy, as it allows for automated anomaly detection and predictive maintenance. As businesses increasingly seek to leverage these advancements, the system monitoring market is poised for significant growth, driven by the demand for smarter, more efficient monitoring solutions.

Increased Regulatory Compliance Requirements

The landscape of regulatory compliance is becoming increasingly stringent, compelling organizations to adopt robust monitoring solutions. the system monitoring market is seeing a rise in demand for tools that ensure adherence to various industry regulations and standards.. Companies are investing in monitoring systems that provide comprehensive reporting and auditing capabilities, enabling them to demonstrate compliance effectively. This trend is particularly pronounced in sectors such as finance and healthcare, where regulatory scrutiny is intense. As organizations navigate these complex compliance landscapes, the system monitoring market is expected to grow, driven by the need for transparency and accountability in operations.