Focus on Cybersecurity

The rising focus on cybersecurity is significantly influencing the Global System Monitoring Market Industry. As cyber threats become more sophisticated, organizations are prioritizing the implementation of monitoring solutions to safeguard sensitive data and infrastructure. These systems enable real-time threat detection and response, thereby enhancing overall security posture. For example, financial services firms are deploying advanced monitoring tools to identify unusual transaction patterns indicative of fraud. This heightened emphasis on cybersecurity is expected to drive market growth, as organizations allocate resources to bolster their defenses against potential breaches.

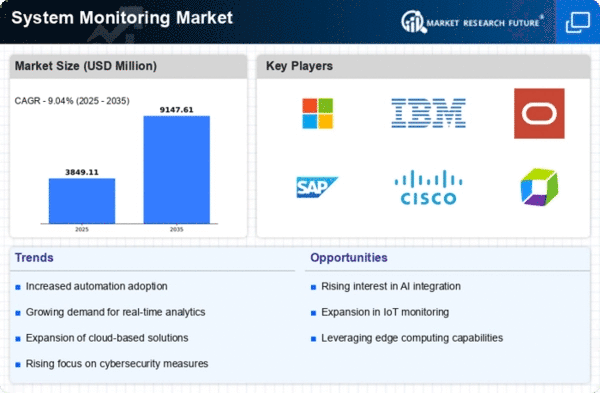

Market Growth Projections

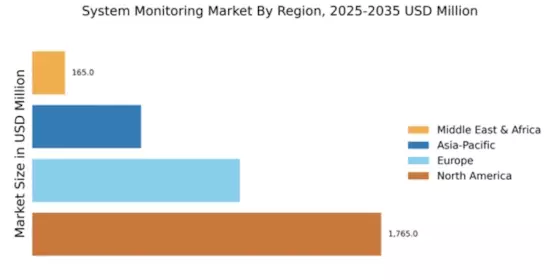

The Global System Monitoring Market Industry is projected to experience substantial growth, with estimates indicating a market value of 3.53 USD Billion in 2024 and a remarkable increase to 9.15 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 9.05% from 2025 to 2035. Such projections suggest a robust demand for monitoring solutions across various sectors, driven by technological advancements and the increasing need for real-time data insights. The market's expansion is indicative of a broader trend towards enhanced operational efficiency and data-driven decision-making.

Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies is a pivotal driver in the Global System Monitoring Market Industry. As IoT devices proliferate, they generate vast amounts of data that require sophisticated monitoring solutions for effective management. This integration enables organizations to optimize resource utilization and improve predictive maintenance strategies. For example, smart sensors in industrial settings allow for continuous monitoring of equipment health, reducing downtime and maintenance costs. The anticipated growth of the market, reaching 9.15 USD Billion by 2035, underscores the potential of IoT-driven monitoring solutions.

Regulatory Compliance and Standards

Regulatory compliance remains a critical driver in the Global System Monitoring Market Industry. Organizations are compelled to adhere to stringent regulations across various sectors, including finance, healthcare, and environmental management. Monitoring systems play a crucial role in ensuring compliance by providing accurate and timely data reporting. For instance, financial institutions utilize monitoring solutions to detect fraudulent activities and maintain transparency. The increasing complexity of regulations necessitates advanced monitoring technologies, thereby propelling market growth as organizations invest in systems that facilitate compliance and mitigate risks.

Growing Adoption of Cloud-Based Solutions

The growing adoption of cloud-based solutions is transforming the Global System Monitoring Market Industry. Organizations are increasingly migrating their monitoring systems to cloud platforms, which offer scalability, flexibility, and cost-effectiveness. Cloud-based monitoring solutions enable businesses to access data from anywhere, facilitating remote management and real-time analytics. For instance, companies in the retail sector utilize cloud-based systems to monitor inventory levels and customer behavior, enhancing operational efficiency. This trend is likely to contribute to the market's expansion, as more organizations recognize the benefits of cloud technology in their monitoring strategies.

Increasing Demand for Real-Time Monitoring

The Global System Monitoring Market Industry experiences a surge in demand for real-time monitoring solutions across various sectors. Organizations are increasingly recognizing the necessity of immediate data access to enhance operational efficiency and decision-making processes. For instance, industries such as manufacturing and healthcare are adopting advanced monitoring systems to track performance metrics and ensure compliance with regulatory standards. This trend is projected to contribute to the market's growth, with an estimated value of 3.53 USD Billion in 2024, indicating a robust interest in technologies that facilitate real-time insights.