Focus on Patient Safety

Patient safety remains a critical concern within the healthcare sector, driving the surgical tubing market towards higher standards of quality and reliability. Regulatory bodies in the US emphasize the need for stringent testing and certification of medical devices, including surgical tubing. This focus on safety compels manufacturers to adopt best practices in production and quality assurance, ensuring that their products meet or exceed regulatory requirements. As a result, companies that prioritize patient safety and invest in quality control measures are likely to enhance their reputation and market share. Furthermore, the increasing awareness among healthcare professionals and patients regarding the importance of using safe and effective medical devices further propels the demand for high-quality surgical tubing in the market.

Increasing Surgical Procedures

The surgical tubing market is significantly influenced by the increasing number of surgical procedures performed in the US. Factors such as advancements in minimally invasive techniques and the rising incidence of surgeries related to chronic conditions contribute to this trend. According to recent data, the number of surgical procedures is expected to rise by approximately 3% annually, leading to a corresponding increase in demand for surgical tubing. This trend is particularly evident in specialties such as orthopedics, cardiology, and general surgery, where the need for reliable and high-quality surgical tubing is paramount. As healthcare providers strive to improve patient outcomes, the demand for advanced surgical tubing solutions continues to grow, positioning manufacturers to capitalize on this expanding market.

Innovations in Material Science

Innovations in material science significantly impact the surgical tubing market, as manufacturers explore new materials that enhance performance and safety. The introduction of biocompatible and durable materials allows for the production of surgical tubing that meets stringent medical standards. For instance, advancements in polymer technology have led to the development of tubing that is not only flexible but also resistant to kinking and abrasion. This is crucial for ensuring the reliability of medical devices. Furthermore, the market is witnessing a shift towards the use of eco-friendly materials, aligning with the growing emphasis on sustainability in the healthcare industry. As a result, companies that invest in research and development of innovative materials are likely to gain a competitive advantage in the surgical tubing market.

Growth of Home Healthcare Services

The surgical tubing market is experiencing growth due to the rising trend of home healthcare services in the US. As more patients opt for at-home treatments and monitoring, the demand for medical devices, including surgical tubing, is on the rise. This shift is driven by the desire for convenience, cost-effectiveness, and personalized care. Home healthcare services often require specialized tubing for various applications, such as intravenous therapy and wound care. The market is projected to expand as healthcare providers increasingly adopt telehealth solutions and remote monitoring technologies. Consequently, manufacturers that cater to the needs of home healthcare services are likely to find new opportunities for growth within the surgical tubing market.

Rising Demand in Healthcare Sector

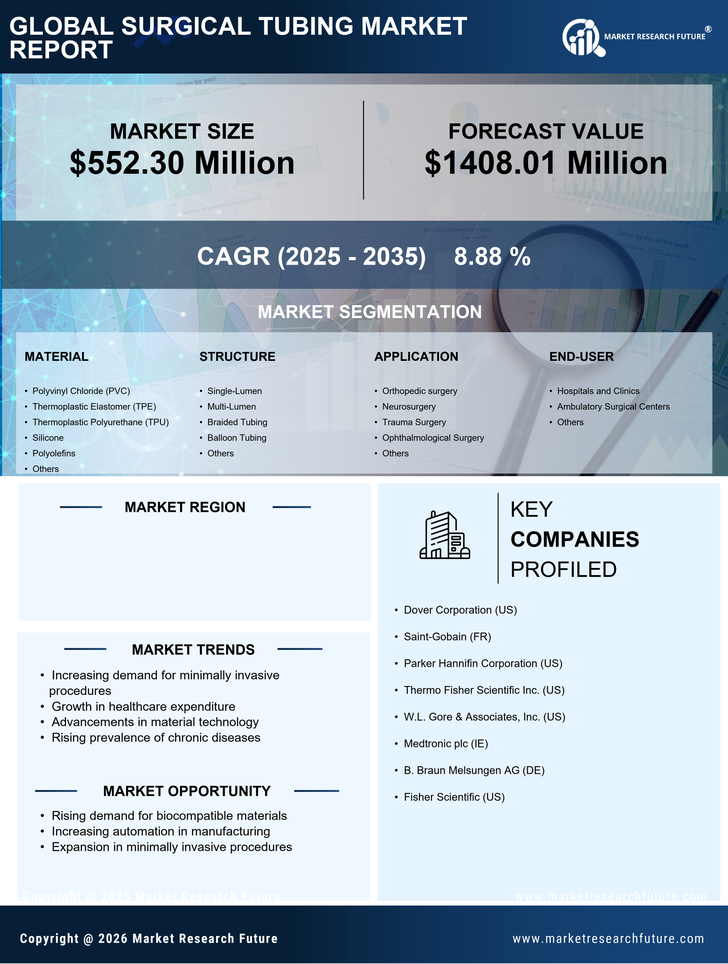

The surgical tubing market experiences a notable surge in demand, primarily driven by the expanding healthcare sector in the US. As the population ages and the prevalence of chronic diseases increases, healthcare facilities require more surgical tubing for various applications, including medical devices and surgical procedures. The market is projected to grow at a CAGR of approximately 5.5% over the next few years, reflecting the increasing reliance on advanced medical technologies. This growth is further supported by the rising number of surgical procedures performed annually, which necessitates the use of high-quality surgical tubing. Consequently, manufacturers are focusing on innovation and product development to meet the evolving needs of healthcare providers, thereby enhancing their competitive edge in the surgical tubing market.