Government Funding and Support

Government initiatives and funding are vital drivers of the space robotics market. The U.S. government has allocated substantial budgets for space exploration, with agencies like NASA investing heavily in robotic missions. For example, NASA's Artemis program aims to return humans to the Moon, with a significant focus on robotic technologies for exploration and habitat construction. In 2025, the budget for space exploration is expected to exceed $25 billion, with a considerable portion directed towards robotics. This financial support not only fosters innovation but also encourages private sector participation, further stimulating growth in the space robotics market. The collaboration between government and private entities is likely to enhance the development of advanced robotic systems.

Rising Demand for Space Exploration

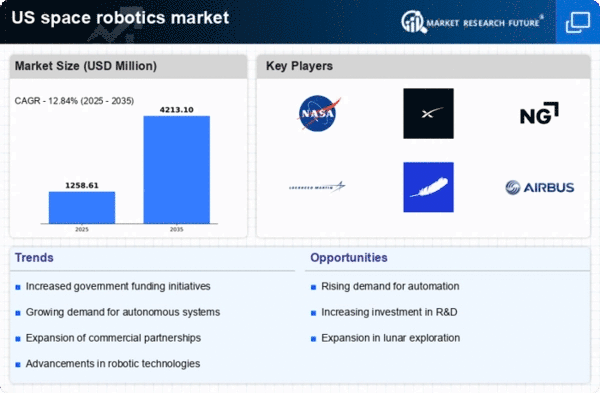

The increasing interest in space exploration is a key driver of the space robotics market. As both governmental and private entities pursue ambitious missions, the need for advanced robotic systems becomes more pronounced. Companies like SpaceX and Blue Origin are leading the charge, with plans for lunar and Martian missions that require sophisticated robotics for tasks such as resource extraction and habitat construction. The market is anticipated to reach a valuation of $5 billion by 2030, reflecting the growing demand for robotic solutions in space. This trend indicates a shift towards more sustainable and efficient exploration methods, positioning the space robotics market as a critical component of future space endeavors.

Technological Innovations in Robotics

Technological innovations are reshaping the landscape of the space robotics market. Developments in materials science, sensor technology, and robotic design are enabling the creation of more resilient and capable robotic systems. For instance, advancements in lightweight materials allow for the construction of robots that can withstand harsh space environments while maintaining agility. Additionally, improved sensors enhance the robots' ability to navigate and perform tasks autonomously. The market is expected to grow by approximately 20% in the next five years, driven by these innovations. As technology continues to advance, the capabilities of space robots will expand, allowing for more complex missions and operations in extraterrestrial environments.

Advancements in AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning technologies is transforming the space robotics market. These advancements enable robots to perform complex tasks autonomously, enhancing their operational efficiency. For instance, AI algorithms can analyze vast amounts of data from space missions, allowing robots to make real-time decisions. This capability is crucial for missions to Mars and beyond, where communication delays with Earth can hinder operations. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by these technological innovations. As AI continues to evolve, it is likely to play a pivotal role in the development of more sophisticated robotic systems, thereby expanding the space robotics market significantly.

Increased Collaboration Between Private and Public Sectors

The collaboration between private companies and public agencies is a significant driver of the space robotics market. Partnerships between organizations like NASA and private firms such as Northrop Grumman and Lockheed Martin are fostering innovation and accelerating the development of robotic technologies. These collaborations often result in shared resources, expertise, and funding, which can lead to more efficient project execution. In 2025, the number of joint ventures in the space robotics sector is expected to increase, reflecting a growing trend towards cooperative efforts. This synergy not only enhances the capabilities of robotic systems but also contributes to the overall growth of the space robotics market, as it encourages the development of cutting-edge technologies.