Evolving Consumer Attitudes

The sextech market is experiencing a notable shift in consumer attitudes towards sexual wellness and technology. Increasingly, individuals are embracing the idea of integrating technology into their intimate lives, which is reflected in the growing acceptance of sextech products. Surveys indicate that approximately 60% of adults in the US are open to using technology to enhance their sexual experiences. This evolving mindset is driving demand for innovative products, such as smart sex toys and apps designed to improve sexual health. As societal norms continue to evolve, the sextech market is likely to see sustained growth, with consumers seeking products that align with their values and enhance their overall well-being.

Increased Focus on Inclusivity

Inclusivity is becoming a central theme in the sextech market, as companies recognize the importance of catering to diverse consumer needs. This shift is evident in the development of products designed for various sexual orientations, gender identities, and physical abilities. By prioritizing inclusivity, brands are not only expanding their customer base but also fostering a sense of community among users. Research indicates that approximately 45% of consumers are more likely to purchase products from brands that promote inclusivity. This trend is likely to drive growth in the sextech market, as companies that embrace diversity can differentiate themselves in a competitive landscape.

Expansion of E-commerce Platforms

The expansion of e-commerce platforms is transforming the way consumers access products in the sextech market. With the rise of online shopping, consumers are increasingly turning to digital platforms for their sexual wellness needs. This shift is particularly relevant in the US, where online sales of sextech products have surged by over 40% in the past year. E-commerce allows for greater privacy and convenience, enabling consumers to explore a wider range of products without the stigma often associated with in-store purchases. As e-commerce continues to grow, it is likely to play a pivotal role in shaping the future of the sextech market, providing opportunities for brands to reach new audiences.

Growing Awareness of Sexual Health

The growing awareness of sexual health is significantly impacting the sextech market. As individuals become more informed about sexual wellness, there is an increasing demand for products that promote safe and healthy sexual practices. Educational campaigns and resources are helping to destigmatize discussions around sexual health, leading to a more informed consumer base. In 2025, the market for sexual wellness products is projected to account for over 25% of the overall sextech market. This heightened awareness is encouraging consumers to seek out innovative solutions that address their sexual health needs, thereby driving growth in the industry.

Investment in Research and Development

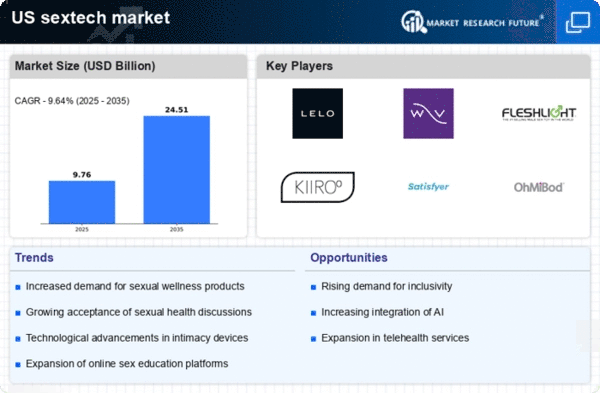

Investment in research and development within the sextech market is crucial for fostering innovation and creating new products. Companies are increasingly allocating resources to explore cutting-edge technologies, such as artificial intelligence and virtual reality, to enhance user experiences. In 2025, it is estimated that the US sextech market will reach a valuation of $30 billion, driven by advancements in product design and functionality. This influx of investment not only supports the development of new products but also encourages collaboration between tech companies and sexual health experts, leading to more effective and user-friendly solutions. As a result, the sextech market is poised for significant growth as it continues to innovate.