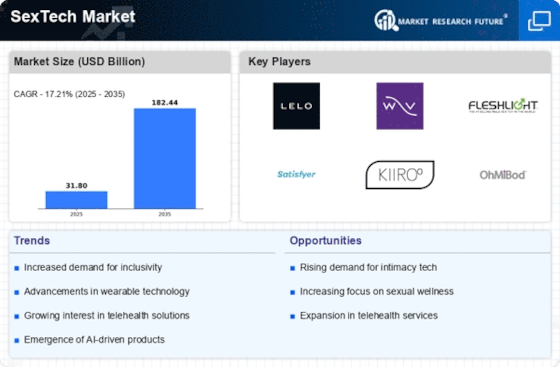

The SexTech Market is currently characterized by a dynamic competitive landscape, driven by innovation, consumer demand for personalized experiences, and the increasing acceptance of sexual wellness products. Key players such as LELO (SE), We-Vibe (CA), and Fleshlight (US) are strategically positioning themselves through a combination of product diversification, technological advancements, and targeted marketing campaigns. LELO (SE), for instance, emphasizes luxury and design in its offerings, while We-Vibe (CA) focuses on enhancing couple's intimacy through innovative technology.

Fleshlight (US) has carved a niche in the male pleasure segment, leveraging brand loyalty and extensive distribution channels to maintain its market presence. Collectively, these strategies contribute to a moderately fragmented market structure, where competition is fierce yet offers opportunities for differentiation through unique value propositions. In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. This approach not only mitigates risks associated with The SexTech Market demands.

The competitive structure of the SexTech Market appears to be moderately fragmented, with several key players exerting influence while also facing challenges from emerging brands. The collective actions of these companies indicate a trend towards consolidation, as larger firms seek to acquire innovative startups to bolster their product lines and technological capabilities. In August 2025, LELO (SE) announced the launch of a new line of eco-friendly products, marking a significant shift towards sustainability in their manufacturing processes. This strategic move not only aligns with growing consumer preferences for environmentally conscious products but also positions LELO (SE) as a leader in sustainable practices within the industry. The emphasis on eco-friendliness could potentially attract a broader customer base, enhancing brand loyalty and market share.

In September 2025, We-Vibe (CA) unveiled a partnership with a leading telehealth platform to integrate sexual wellness consultations into their product offerings. This collaboration signifies a strategic pivot towards digital health solutions, allowing We-Vibe (CA) to provide a more holistic approach to sexual wellness. By combining product sales with professional guidance, the company may enhance customer engagement and satisfaction, thereby solidifying its market position. In July 2025, Fleshlight (US) expanded its product line to include a subscription service, catering to the growing trend of personalized consumer experiences. This initiative not only diversifies their revenue streams but also fosters customer retention through ongoing engagement. The subscription model could potentially reshape consumer purchasing behaviors, encouraging repeat business and enhancing brand loyalty.

As of October 2025, the SexTech Market is witnessing a pronounced shift towards digitalization, with companies increasingly integrating artificial intelligence and data analytics into their product development and marketing strategies. The rise of strategic alliances, such as partnerships between manufacturers and health tech firms, is reshaping the competitive landscape, fostering innovation and expanding market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, product quality, and supply chain reliability. This transition underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive edge in the ever-evolving SexTech Market.