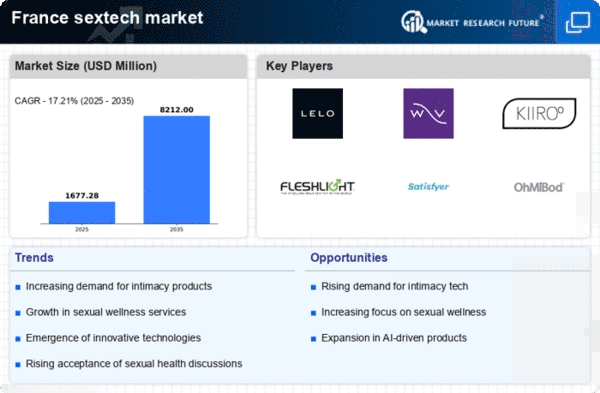

Evolving Attitudes Towards Sexuality

The evolving attitudes towards sexuality in France appear to be a significant driver for the sextech market. As societal norms shift, there is an increasing acceptance of sexual wellness and exploration. This cultural transformation is reflected in the growing demand for innovative products that cater to diverse sexual preferences. In recent years, surveys indicate that approximately 60% of French adults express openness to discussing sexual health and wellness, which has led to a surge in the market. The sextech market is likely to benefit from this trend, as consumers seek products that align with their evolving views on sexuality, thereby fostering a more inclusive environment.

Regulatory Changes Supporting Innovation

Regulatory changes in France are fostering an environment conducive to innovation within the sextech market. Recent legislative efforts aimed at promoting sexual health and wellness have led to a more favorable landscape for sextech companies. These changes may include streamlined approval processes for new products and increased funding for research and development. As a result, the sextech market is likely to experience accelerated growth, with new entrants and established players alike capitalizing on these opportunities. The potential for innovation is vast, as companies explore new technologies and concepts that align with evolving consumer expectations.

Increased Focus on Sexual Health Education

An increased focus on sexual health education in France is emerging as a pivotal driver for the sextech market. Educational initiatives aimed at promoting sexual wellness and safe practices are gaining traction, particularly among younger demographics. This shift is likely to lead to a more informed consumer base that actively seeks out products that enhance their sexual experiences. Reports suggest that around 70% of French youth are now more aware of sexual health issues compared to previous generations. Consequently, the sextech market stands to benefit from this heightened awareness, as consumers become more discerning in their purchasing decisions.

Rising Demand for Personalized Experiences

The rising demand for personalized experiences is significantly influencing the sextech market in France. Consumers increasingly seek products that cater to their individual preferences and needs, leading to a surge in customizable options within the market. This trend is evident in the growing popularity of subscription services that offer tailored sexual wellness products. Market analysis indicates that personalized offerings could account for up to 30% of total sales in the sextech market by 2027. As brands respond to this demand, they are likely to enhance customer loyalty and satisfaction, further driving market growth.

Technological Advancements in Product Development

Technological advancements play a crucial role in shaping the sextech market in France. The integration of cutting-edge technologies, such as artificial intelligence and virtual reality, into sexual wellness products is transforming user experiences. For instance, the market for smart sex toys has seen a notable increase, with sales projected to reach €200 million by 2026. These innovations not only enhance user satisfaction but also promote safer sexual practices. The sextech market is thus positioned to thrive as manufacturers leverage technology to create more personalized and engaging products, appealing to a tech-savvy consumer base.