Increased Cybersecurity Threats

The US Security Operation Center Market is significantly influenced by the rising frequency and sophistication of cyber threats. High-profile data breaches and ransomware attacks have underscored the necessity for organizations to enhance their security postures. According to the FBI's Internet Crime Complaint Center, reported cybercrime incidents have surged, with losses exceeding USD 4.2 billion in 2020 alone. This alarming trend is prompting businesses to invest heavily in Security Operation Centers that can provide continuous monitoring and rapid incident response capabilities. As the threat landscape continues to evolve, the demand for comprehensive security solutions is likely to escalate, further propelling the growth of the Security Operation Center market in the US.

Adoption of Cloud-Based Solutions

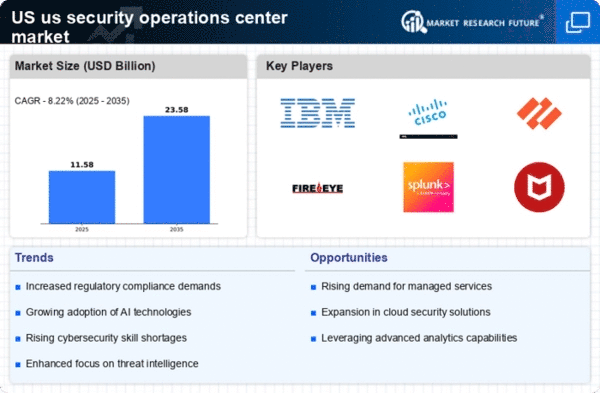

The US Security Operation Center Market is increasingly witnessing the adoption of cloud-based security solutions. Organizations are migrating to cloud environments to enhance flexibility and scalability, which necessitates the establishment of Security Operation Centers that can effectively monitor and protect these cloud infrastructures. The Security Operation Center is projected to grow to USD 12.73 billion by 2025, reflecting a significant shift in how security is managed. This transition to cloud-based solutions is likely to drive the demand for Security Operation Centers that specialize in cloud security, as businesses seek to mitigate risks associated with cloud adoption. Consequently, this trend may lead to the emergence of new service offerings tailored to the unique challenges posed by cloud environments.

Growing Demand for Skilled Workforce

The US Security Operation Center Market is witnessing a growing demand for a skilled workforce capable of managing complex security environments. As cyber threats evolve, the need for professionals with expertise in cybersecurity, threat intelligence, and incident response is becoming critical. Reports indicate that the cybersecurity workforce gap in the US is projected to reach 3.5 million by 2025, highlighting the urgency for organizations to invest in training and development. This demand for skilled personnel is likely to drive the establishment of more Security Operation Centers, as companies seek to bolster their defenses against increasingly sophisticated cyber threats. Consequently, the market may see a rise in educational programs and certifications aimed at equipping individuals with the necessary skills.

Integration of Advanced Technologies

The US Security Operation Center Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance threat detection and response capabilities, allowing security teams to analyze vast amounts of data in real-time. According to recent estimates, the market for AI in cybersecurity is projected to reach USD 46 billion by 2027, indicating a robust growth trajectory. This integration not only improves operational efficiency but also reduces response times to incidents, which is critical in mitigating potential damages. As organizations increasingly adopt these technologies, the demand for sophisticated Security Operation Centers that can leverage these advancements is likely to rise, further driving market growth.

Focus on Compliance and Regulatory Standards

In the US Security Operation Center Market, compliance with regulatory standards is becoming increasingly paramount. Organizations are required to adhere to various regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the Federal Information Security Management Act (FISMA). These regulations necessitate the implementation of robust security measures, which in turn drives the demand for Security Operation Centers that can ensure compliance. The market is expected to grow as companies invest in solutions that not only protect sensitive data but also meet regulatory requirements. This focus on compliance is likely to create opportunities for Security Operation Centers to offer specialized services that cater to specific industry regulations, thereby enhancing their market position.