Rising Cyber Threat Landscape

The GCC security operations center market is experiencing a notable surge in demand due to the escalating cyber threat landscape. With the proliferation of sophisticated cyber attacks, organizations are compelled to enhance their security measures. Reports indicate that cybercrime costs are projected to reach USD 10.5 trillion annually by 2025, underscoring the urgency for robust security operations. Governments in the GCC region are increasingly prioritizing cybersecurity, leading to the establishment of national cybersecurity strategies. For instance, the UAE has launched the National Cybersecurity Strategy, which aims to bolster the country's defenses against cyber threats. This heightened awareness and investment in cybersecurity infrastructure are driving the growth of the GCC security operations center market.

Regulatory Compliance and Standards

The GCC security operations center market is significantly influenced by the need for regulatory compliance and adherence to international standards. Governments in the region are implementing stringent regulations to safeguard sensitive data and ensure cybersecurity resilience. For example, the Saudi Arabian government has introduced the Essential Cybersecurity Controls framework, which mandates organizations to adopt specific security measures. Compliance with such regulations not only mitigates risks but also enhances the credibility of organizations in the eyes of stakeholders. As businesses strive to meet these regulatory requirements, the demand for advanced security operations centers is likely to increase, thereby propelling the growth of the GCC security operations center market.

Integration of Advanced Technologies

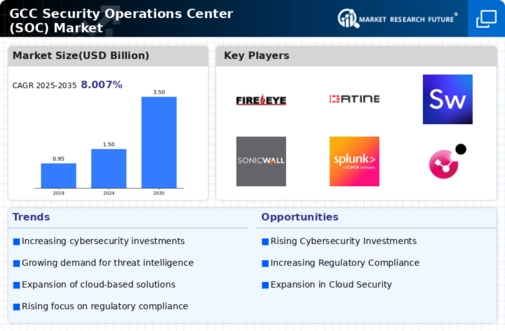

The GCC security operations center market is witnessing a transformative shift with the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enable security operations centers to analyze vast amounts of data in real-time, enhancing threat detection and response capabilities. The adoption of AI-driven solutions is expected to grow significantly, with market analysts projecting a compound annual growth rate of over 20% in the coming years. Organizations in the GCC are increasingly leveraging these technologies to automate routine security tasks, allowing human analysts to focus on more complex threats. This integration not only improves operational efficiency but also strengthens the overall security posture of organizations, thereby driving the growth of the GCC security operations center market.

Investment in Smart City Initiatives

The GCC security operations center market is poised for growth due to the region's ambitious smart city initiatives. Countries like Saudi Arabia and the UAE are investing heavily in smart city projects, which integrate advanced technologies to enhance urban living. These initiatives necessitate robust cybersecurity measures to protect critical infrastructure and citizen data. For instance, the NEOM project in Saudi Arabia aims to create a technologically advanced city, which will require sophisticated security operations to safeguard against potential cyber threats. As these smart city projects progress, the demand for security operations centers that can monitor and respond to threats in real-time is expected to rise, thereby driving the GCC security operations center market.

Growing Awareness of Cybersecurity Importance

The GCC security operations center market is benefiting from a growing awareness of the importance of cybersecurity among organizations. As businesses increasingly recognize the potential financial and reputational damage caused by cyber incidents, there is a shift towards proactive security measures. Surveys indicate that over 70% of organizations in the GCC are prioritizing cybersecurity investments in their budgets. This heightened awareness is prompting companies to establish or enhance their security operations centers to effectively monitor and respond to threats. Furthermore, educational initiatives and training programs are being implemented to equip personnel with the necessary skills to combat cyber threats. This trend is likely to sustain the growth of the GCC security operations center market.