Rising Cyber Threat Landscape

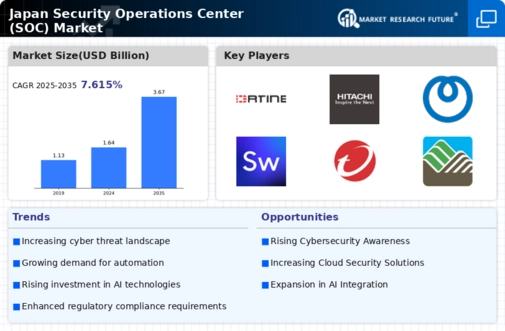

The Japan security operations center market is experiencing a notable surge in demand due to the escalating cyber threat landscape. With cyberattacks becoming increasingly sophisticated, organizations are compelled to enhance their security measures. In 2025, Japan reported a 30% increase in cyber incidents compared to the previous year, prompting businesses to invest in advanced security operations centers. This trend indicates a growing recognition of the need for proactive threat detection and response capabilities. As a result, the market is likely to expand as companies seek to fortify their defenses against potential breaches, thereby driving the growth of the Japan security operations center market.

Emergence of Advanced Technologies

The integration of advanced technologies is reshaping the Japan security operations center market. Innovations such as machine learning, artificial intelligence, and automation are enhancing the capabilities of security operations centers, enabling them to detect and respond to threats more efficiently. In 2025, it is estimated that over 50% of security operations centers in Japan will incorporate AI-driven solutions to improve threat intelligence and incident response times. This technological evolution not only enhances the effectiveness of security measures but also positions the Japan security operations center market at the forefront of cybersecurity advancements, driving further investment and development.

Government Initiatives and Support

The Japan security operations center market benefits significantly from government initiatives aimed at bolstering national cybersecurity. The Japanese government has implemented various policies to enhance the cybersecurity framework, including the Cybersecurity Strategy of 2021, which emphasizes the establishment of robust security operations centers. This strategic focus is likely to encourage public and private sector collaboration, leading to increased investments in security infrastructure. Furthermore, government funding and support for cybersecurity training programs are expected to cultivate a skilled workforce, thereby enhancing the capabilities of the Japan security operations center market.

Growing Adoption of Cloud-Based Solutions

The shift towards cloud computing is transforming the Japan security operations center market. Organizations are increasingly adopting cloud-based security solutions to enhance their operational efficiency and scalability. According to recent data, approximately 40% of Japanese enterprises have migrated their security operations to the cloud, driven by the need for flexibility and cost-effectiveness. This trend suggests that cloud-based security operations centers are becoming a preferred choice for businesses seeking to streamline their security processes. As more organizations embrace this model, the Japan security operations center market is poised for substantial growth, reflecting the evolving landscape of cybersecurity.

Increased Regulatory Compliance Requirements

The Japan security operations center market is significantly influenced by the rising regulatory compliance requirements across various sectors. Organizations are mandated to adhere to stringent data protection laws, such as the Act on the Protection of Personal Information (APPI). Compliance with these regulations necessitates the establishment of comprehensive security operations centers capable of monitoring and managing data security effectively. As businesses strive to meet these legal obligations, the demand for specialized security services is likely to increase. This trend underscores the critical role of the Japan security operations center market in helping organizations navigate the complexities of regulatory compliance.