Growing E-commerce Sector

The rapid expansion of the e-commerce sector significantly influences the Global Delivery Robots Market Industry. As consumers increasingly turn to online shopping, the demand for efficient and timely delivery solutions intensifies. Delivery robots offer a unique advantage by providing last-mile delivery services that are cost-effective and environmentally friendly. This trend is expected to propel the market to an estimated 7.81 USD Billion in 2024. Major e-commerce players are exploring partnerships with robotics companies to enhance their delivery capabilities. The integration of delivery robots into e-commerce logistics not only improves customer satisfaction but also streamlines operations, making it a critical driver of market growth.

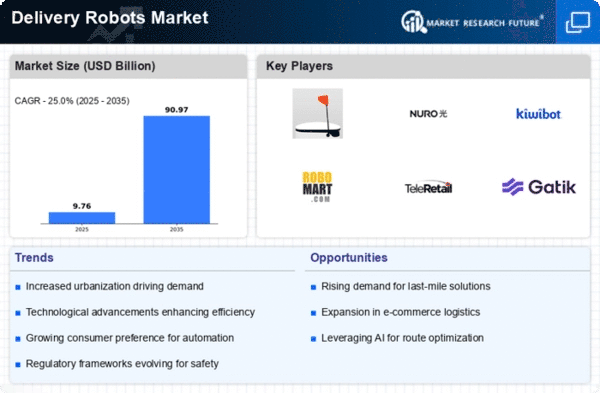

Market Growth Projections

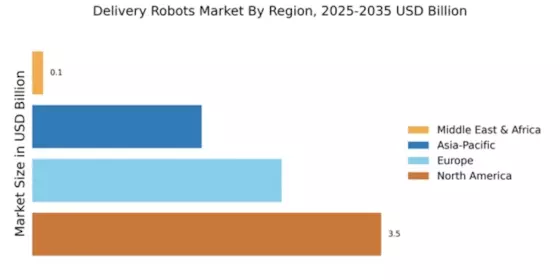

The Global Delivery Robots Market Industry is poised for remarkable growth, with projections indicating a substantial increase in market value. By 2024, the market is expected to reach 7.81 USD Billion, and by 2035, it could soar to 91.0 USD Billion. This growth trajectory suggests a compound annual growth rate of 25.01% from 2025 to 2035. Factors contributing to this expansion include technological advancements, increasing demand for contactless delivery, and supportive regulatory frameworks. As the market evolves, it is likely to attract significant investment, fostering innovation and competition among key players in the industry.

Supportive Regulatory Frameworks

The Global Delivery Robots Market Industry benefits from supportive regulatory frameworks that facilitate the deployment of delivery robots in urban areas. Governments are increasingly recognizing the potential of autonomous delivery systems to alleviate traffic congestion and reduce carbon emissions. As regulations evolve, cities are establishing guidelines that allow for the safe operation of delivery robots on public roads. This regulatory support is crucial for the growth of the market, as it encourages investment and innovation. By 2025, the market is likely to experience a compound annual growth rate of 25.01% through 2035, driven by favorable policies that promote the integration of delivery robots into existing logistics networks.

Urbanization and Population Growth

Urbanization and population growth are key factors driving the Global Delivery Robots Market Industry. As more people migrate to urban centers, the demand for efficient delivery solutions escalates. Delivery robots are well-suited for navigating congested city streets, providing a practical solution to the challenges posed by urban logistics. The increasing population density in metropolitan areas creates a pressing need for innovative delivery methods that can keep pace with consumer expectations. This trend is likely to contribute to the market's projected growth, with estimates suggesting a rise to 91.0 USD Billion by 2035. The ability of delivery robots to operate in densely populated areas positions them as a vital component of future urban logistics.

Rising Demand for Contactless Delivery

The Global Delivery Robots Market Industry experiences a notable surge in demand for contactless delivery solutions. This trend is driven by consumer preferences for safety and convenience, particularly in urban areas. As e-commerce continues to expand, delivery robots are increasingly seen as a viable solution to meet consumer expectations. In 2024, the market is projected to reach 7.81 USD Billion, reflecting a growing acceptance of automated delivery systems. Companies such as Starship Technologies and Nuro are leading the charge, deploying robots in various cities worldwide. This shift towards automation not only enhances efficiency but also aligns with the evolving landscape of consumer behavior.

Technological Advancements in Robotics

Technological advancements play a pivotal role in shaping the Global Delivery Robots Market Industry. Innovations in artificial intelligence, machine learning, and sensor technology enhance the capabilities of delivery robots, enabling them to navigate complex urban environments. These advancements contribute to improved safety, efficiency, and reliability of delivery services. As a result, the market is expected to witness substantial growth, with projections indicating a rise to 91.0 USD Billion by 2035. Companies are increasingly investing in research and development to create more sophisticated robots that can operate autonomously, thereby reducing operational costs and improving service delivery.