Increased Availability of Refurbished Devices

The refurbished smartphone market is witnessing an increase in the availability of devices, driven by both manufacturers and third-party sellers. Major brands are now offering certified refurbished options, which enhances consumer trust in the quality of these products. This expansion in the refurbished smartphone market is supported by a growing network of retailers and online platforms that specialize in refurbished devices. As a result, consumers have greater access to a diverse range of smartphones, which is likely to stimulate market growth. The convenience of purchasing refurbished devices online has also contributed to this trend, making it easier for consumers to find suitable options.

Rising Awareness of Warranty and Support Options

The refurbished smartphone market is experiencing a rise in consumer awareness regarding warranty and support options available for refurbished devices. Many sellers now offer warranties that rival those of new smartphones, which enhances consumer confidence in purchasing refurbished products. This trend is particularly relevant in the refurbished smartphone market, where buyers are often concerned about the longevity and reliability of their devices. Data indicates that nearly 60% of consumers are more likely to purchase a refurbished smartphone if a warranty is included. This growing awareness is likely to drive further interest in refurbished devices, as consumers seek assurance in their investment.

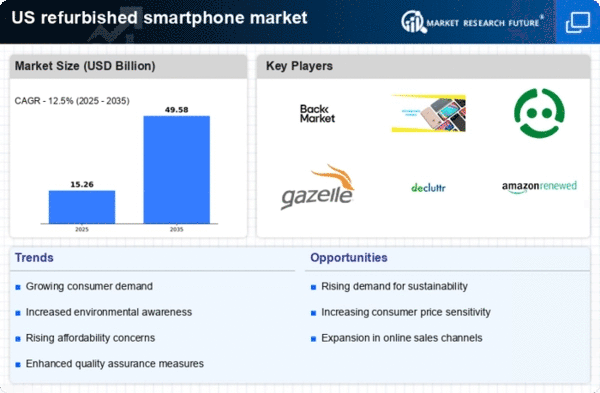

Growing Consumer Demand for Affordable Technology

The refurbished smartphone market is experiencing a notable increase in consumer demand for affordable technology solutions. As individuals seek to balance quality and cost, the appeal of refurbished devices has surged. Recent data indicates that approximately 30% of consumers in the US are considering purchasing refurbished smartphones as a viable alternative to new models. This trend is driven by the desire for high-quality devices at lower price points, which aligns with the financial constraints many face. The refurbished smartphone market is thus positioned to cater to this growing segment, offering a range of options that meet consumer expectations for performance and reliability.

Environmental Considerations and E-Waste Reduction

The refurbished smartphone market is increasingly influenced by environmental considerations, particularly the need to reduce electronic waste (e-waste). With millions of smartphones discarded annually, the refurbished smartphone market presents a sustainable solution by extending the lifecycle of devices. Data suggests that refurbishing a smartphone can reduce its carbon footprint by up to 70%, making it an attractive option for environmentally conscious consumers. This growing awareness of e-waste issues is prompting more individuals to opt for refurbished devices, thereby driving demand and fostering a more sustainable approach to technology consumption.

Technological Advancements in Refurbishment Processes

The refurbished smartphone market is benefiting from significant technological advancements in refurbishment processes. Innovations in testing, repair, and quality assurance have enhanced the reliability of refurbished devices, making them more appealing to consumers. The refurbished smartphone market is now able to offer products that meet or exceed the performance of new models, often at a fraction of the cost. As a result, consumer confidence in refurbished devices is rising, with studies indicating that 75% of buyers are satisfied with their refurbished purchases. This trend is likely to continue as technology improves, further solidifying the market's position.