Cost-Effectiveness

Cost-effectiveness remains a primary driver for the Refurbished Dental Lab Equipment Market. Dental laboratories often operate under tight budgets, making refurbished equipment an appealing alternative to new purchases. Refurbished equipment can be available at a fraction of the cost of new models, allowing labs to allocate resources more efficiently. This financial advantage is particularly relevant in an industry where profit margins can be narrow. Market analysis shows that the average savings from purchasing refurbished equipment can range from 30% to 50%, which can significantly impact a lab's operational costs. As dental practices continue to seek ways to optimize expenditures, the demand for refurbished equipment is likely to rise.

Sustainability Focus

The increasing emphasis on sustainability within the dental industry appears to drive the Refurbished Dental Lab Equipment Market. As dental practices and laboratories seek to minimize their environmental footprint, refurbished equipment presents a viable solution. This equipment not only reduces waste by extending the lifecycle of existing machines but also lessens the demand for new manufacturing, which can be resource-intensive. According to recent data, the refurbishment process can save up to 70% of the energy required to produce new equipment. Consequently, the growing awareness of environmental issues among dental professionals is likely to enhance the appeal of refurbished options, thereby fostering market growth.

Regulatory Compliance

Regulatory compliance is increasingly shaping the landscape of the Refurbished Dental Lab Equipment Market. As dental practices face stringent regulations regarding equipment safety and efficacy, refurbished equipment that meets these standards becomes essential. Many refurbishment companies ensure that their products comply with relevant health and safety regulations, which can enhance their marketability. This compliance not only assures dental professionals of the quality and reliability of refurbished equipment but also aligns with the industry's commitment to patient safety. Consequently, the assurance of regulatory compliance may drive more dental labs to consider refurbished options as a viable alternative to new equipment.

Technological Advancements

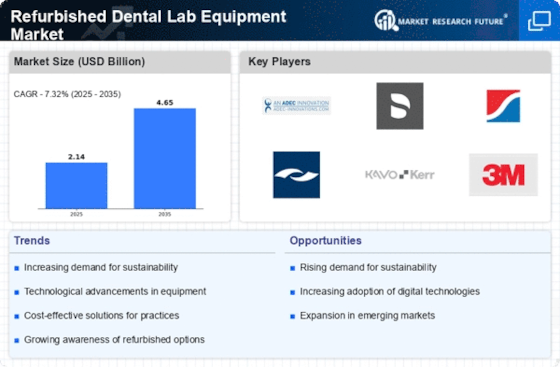

Technological advancements in dental lab equipment are significantly influencing the Refurbished Dental Lab Equipment Market. Innovations in manufacturing processes and materials have led to the production of more durable and efficient equipment. As a result, refurbished machines often incorporate the latest technologies, making them attractive to dental labs looking to upgrade without incurring the high costs associated with new equipment. Data indicates that the market for dental lab equipment is projected to grow at a compound annual growth rate of 6.5% over the next five years, suggesting that refurbished options will play a crucial role in meeting this demand while providing cost-effective solutions.

Market Expansion in Emerging Economies

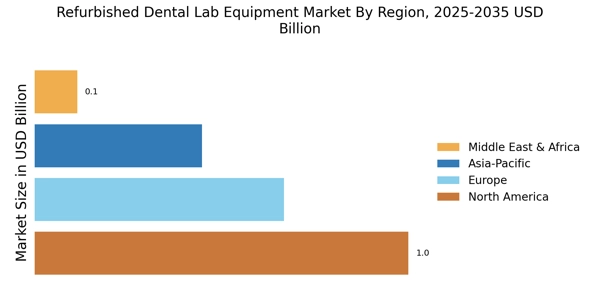

The expansion of dental services in emerging economies is likely to propel the Refurbished Dental Lab Equipment Market. As these regions experience growth in dental care demand, the need for cost-effective solutions becomes paramount. Refurbished equipment offers an accessible entry point for dental labs in these markets, allowing them to equip themselves without the financial burden of new equipment. Reports indicate that the dental market in emerging economies is expected to grow at a rate of 8% annually, suggesting a robust opportunity for refurbished equipment suppliers. This trend indicates that as dental practices expand in these regions, the demand for refurbished equipment will likely increase, further driving market growth.