Supportive Regulatory Framework

The US Photovoltaic Inverter Market benefits from a supportive regulatory environment that encourages solar energy adoption. Federal policies, such as the Investment Tax Credit (ITC), provide financial incentives for solar installations, directly impacting inverter sales. In 2025, the ITC is set to remain at 26%, incentivizing both residential and commercial solar projects. Additionally, various state-level initiatives, including net metering and renewable energy certificates, further stimulate market growth. These regulations create a favorable landscape for photovoltaic inverter manufacturers, as they align with national goals for reducing greenhouse gas emissions and promoting clean energy. As a result, the regulatory framework is a crucial driver for the expansion of the US Photovoltaic Inverter Market.

Advancements in Inverter Technology

Technological innovations are significantly shaping the US Photovoltaic Inverter Market. Recent advancements in inverter technology, such as the development of microinverters and string inverters, enhance the efficiency and reliability of solar energy systems. For instance, microinverters allow for individual panel optimization, which can lead to increased energy production. The market for smart inverters, which integrate advanced features like grid support and real-time monitoring, is also expanding. In 2025, it is estimated that smart inverters will comprise over 50% of the total inverter sales in the US. These technological improvements not only improve performance but also reduce installation and maintenance costs, making solar energy more accessible to a broader audience.

Growing Demand for Renewable Energy

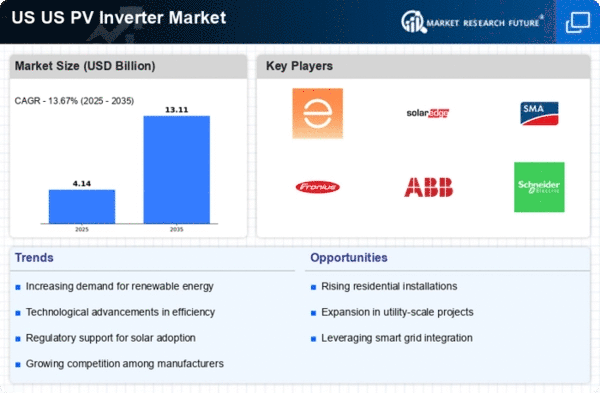

The US Photovoltaic Inverter Market is experiencing a surge in demand driven by the increasing adoption of renewable energy sources. As more states implement renewable portfolio standards, the need for efficient solar energy systems becomes paramount. In 2025, solar energy accounted for approximately 20% of the total electricity generation in the US, indicating a robust growth trajectory. This trend is likely to continue, as consumers and businesses alike seek sustainable energy solutions. The rising awareness of climate change and the need for energy independence further bolster this demand. Consequently, photovoltaic inverters, which are essential for converting solar energy into usable electricity, are witnessing heightened interest and investment, positioning the US Photovoltaic Inverter Market for substantial growth in the coming years.

Increasing Energy Storage Integration

The integration of energy storage systems with photovoltaic inverters is emerging as a significant driver in the US Photovoltaic Inverter Market. As the demand for reliable and resilient energy solutions grows, the combination of solar power and energy storage offers a compelling proposition. In 2025, it is projected that nearly 30% of new solar installations will include energy storage capabilities. This trend is driven by the need for energy independence and the ability to manage energy consumption effectively. Photovoltaic inverters equipped with storage integration capabilities allow users to store excess energy generated during peak sunlight hours for use during periods of low generation. This synergy not only enhances the overall efficiency of solar systems but also positions the US Photovoltaic Inverter Market for continued growth.

Rising Consumer Awareness and Adoption

Consumer awareness regarding the benefits of solar energy is on the rise, significantly impacting the US Photovoltaic Inverter Market. As more individuals and businesses recognize the long-term cost savings and environmental advantages of solar power, the adoption of photovoltaic systems is increasing. Surveys indicate that over 70% of homeowners are considering solar energy as a viable option for their energy needs in 2025. This growing interest is likely to drive demand for photovoltaic inverters, as they are essential components of solar energy systems. Furthermore, educational campaigns and community initiatives are playing a pivotal role in informing consumers about the advantages of solar technology. As awareness continues to grow, the US Photovoltaic Inverter Market is expected to expand, driven by a more informed and engaged consumer base.