Expansion of Research Institutions

The proliferation of research institutions and academic centers in the US is contributing to the growth of the protein sequencing market. With over 2,500 research institutions dedicated to life sciences, the demand for advanced protein sequencing technologies is on the rise. These institutions are increasingly adopting cutting-edge sequencing methods to support various research initiatives, including genomics, proteomics, and systems biology. The protein sequencing market is likely to benefit from this trend, as institutions invest in state-of-the-art equipment and technologies to enhance their research capabilities. This expansion not only increases the volume of protein sequencing projects but also fosters collaboration between academia and industry, creating a dynamic ecosystem that drives innovation.

Rising Investment in Biotechnology

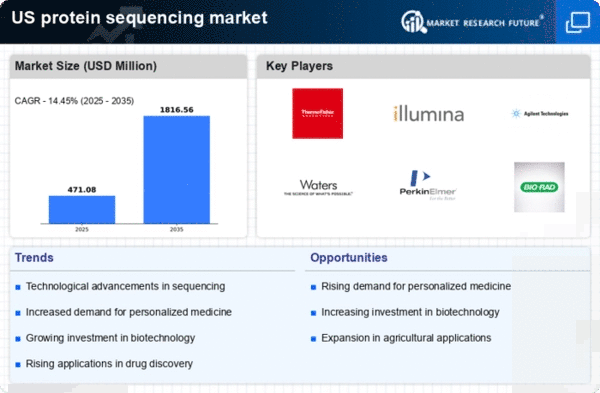

The protein sequencing market is experiencing a surge in investment from both public and private sectors, which is likely to drive innovation and development. In the US, funding for biotechnology research has increased significantly, with federal agencies allocating over $40 billion annually to support life sciences. This influx of capital is fostering advancements in protein sequencing technologies, enabling researchers to explore complex biological systems more effectively. As a result, the protein sequencing market is poised for growth, with projections indicating a compound annual growth rate (CAGR) of approximately 10% over the next five years. This investment trend not only enhances the capabilities of existing technologies but also encourages the emergence of novel solutions, thereby expanding the overall market landscape.

Growing Applications in Drug Discovery

The protein sequencing market is increasingly being utilized in drug discovery processes, which is a critical driver of market growth. Pharmaceutical companies are leveraging protein sequencing to identify potential drug targets and understand disease mechanisms at a molecular level. In the US, the pharmaceutical industry invests around $83 billion annually in research and development, with a significant portion directed towards protein-based therapeutics. This trend indicates a robust demand for protein sequencing technologies, as they provide essential insights that facilitate the development of new drugs. Consequently, the integration of protein sequencing into drug discovery workflows is expected to enhance efficiency and accuracy, further propelling the market forward.

Increased Focus on Precision Agriculture

The protein sequencing market is witnessing a growing interest in precision agriculture, which is reshaping agricultural practices in the US. As farmers seek to optimize crop yields and improve food quality, protein sequencing technologies are being employed to analyze plant proteins and understand their roles in growth and development. This trend is particularly relevant in the context of developing genetically modified organisms (GMOs) and enhancing crop resilience to environmental stressors. The agricultural biotechnology sector is projected to reach $50 billion by 2027, indicating a substantial market opportunity for protein sequencing applications. By integrating protein sequencing into agricultural research, stakeholders can make informed decisions that enhance productivity and sustainability.

Emergence of Advanced Bioinformatics Tools

The protein sequencing market is being significantly influenced by the emergence of advanced bioinformatics tools that facilitate data analysis and interpretation. As sequencing technologies generate vast amounts of data, the need for sophisticated software solutions becomes paramount. In the US, the bioinformatics market is expected to grow at a CAGR of 12% over the next five years, driven by the increasing complexity of biological data. These tools enable researchers to extract meaningful insights from protein sequencing data, thereby enhancing the overall efficiency of research projects. The integration of bioinformatics with protein sequencing is likely to streamline workflows and improve the accuracy of results, ultimately contributing to the growth of the protein sequencing market.