Rising Demand for Microbiome Research

The increasing interest in microbiome research is a pivotal driver for the Metagenomic Sequencing Market. As researchers delve deeper into the human microbiome's role in health and disease, the demand for advanced sequencing technologies surges. This sector is projected to witness substantial growth, with estimates suggesting a market value exceeding USD 1 billion by 2026. The insights gained from metagenomic studies are crucial for understanding complex diseases, leading to a heightened focus on developing innovative sequencing solutions. Consequently, the Metagenomic Sequencing Market is likely to expand as academic institutions and biotech companies invest in cutting-edge technologies to explore microbial communities.

Advancements in Sequencing Technologies

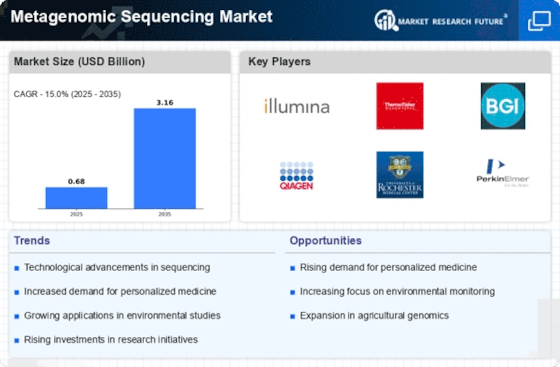

Technological innovations in sequencing methodologies are significantly propelling the Metagenomic Sequencing Market. The advent of next-generation sequencing (NGS) and single-cell sequencing technologies has revolutionized the ability to analyze complex microbial ecosystems. These advancements not only enhance the accuracy and speed of sequencing but also reduce costs, making metagenomic studies more accessible. The market is expected to grow at a compound annual growth rate (CAGR) of over 15% in the coming years, driven by the continuous evolution of sequencing platforms. As a result, the Metagenomic Sequencing Market is poised for expansion, with new applications emerging in environmental monitoring, agriculture, and clinical diagnostics.

Increased Investment in Genomic Research

The surge in funding for genomic research is a critical factor influencing the Metagenomic Sequencing Market. Governments and private organizations are increasingly recognizing the importance of genomics in addressing public health challenges and advancing scientific knowledge. This trend is reflected in the substantial investments made in research initiatives, which are projected to reach USD 10 billion by 2025. Such financial support fosters innovation and encourages the development of novel metagenomic sequencing applications. Consequently, the Metagenomic Sequencing Market is likely to benefit from this influx of capital, facilitating the growth of new technologies and expanding research capabilities.

Emerging Trends in Environmental Monitoring

The Metagenomic Sequencing Market is also being driven by emerging trends in environmental monitoring. As concerns about biodiversity loss and ecosystem health grow, metagenomic sequencing offers powerful tools for assessing microbial diversity and ecosystem functions. This approach is increasingly applied in environmental studies, agriculture, and conservation efforts. The market for environmental applications is projected to expand, with estimates suggesting a growth rate of over 12% annually. By providing insights into microbial communities and their interactions with the environment, metagenomic sequencing is becoming an essential component of ecological research, thereby bolstering the Metagenomic Sequencing Market.

Growing Applications in Clinical Diagnostics

The expanding applications of metagenomic sequencing in clinical diagnostics are driving growth in the Metagenomic Sequencing Market. Healthcare providers are increasingly utilizing metagenomic approaches to identify pathogens and understand complex infections. This trend is particularly evident in the rise of metagenomic next-generation sequencing (mNGS) for diagnosing infectious diseases, which has shown promise in improving patient outcomes. The market for clinical diagnostics is anticipated to grow significantly, with projections indicating a value of USD 500 million by 2025. As healthcare systems adopt these advanced diagnostic tools, the Metagenomic Sequencing Market is expected to experience robust growth.