Growing Demand for Grid Resilience

The power system-simulator market is experiencing a notable surge in demand driven by the increasing need for grid resilience. As the US faces challenges such as extreme weather events and aging infrastructure, utilities are compelled to invest in advanced simulation technologies. These tools enable operators to model various scenarios, assess vulnerabilities, and develop strategies to enhance grid reliability. According to recent data, the market for grid resilience solutions is projected to grow at a CAGR of 8.5% through 2027. This trend indicates a robust opportunity for power system-simulator market players to provide innovative solutions that address these pressing challenges.

Rising Complexity of Energy Systems

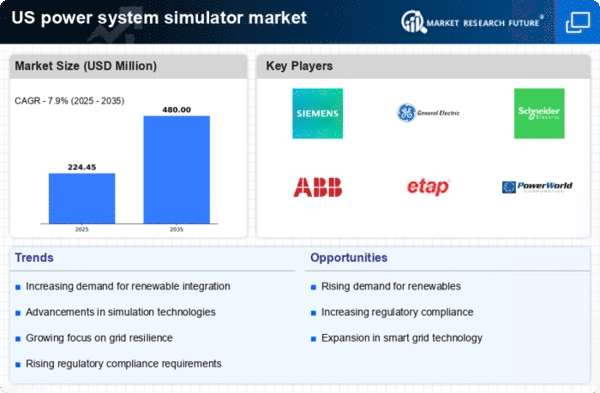

The increasing complexity of energy systems in the US is a significant driver for the power system-simulator market. As the energy landscape evolves with the integration of distributed energy resources, electric vehicles, and renewable energy sources, utilities require sophisticated simulation tools to manage these complexities. The need for accurate modeling and forecasting is paramount, as it enables utilities to make informed decisions regarding grid management. This complexity is expected to drive a growth rate of approximately 7% in the power system-simulator market over the next five years, as stakeholders seek to navigate the challenges posed by modern energy systems.

Investment in Smart Grid Technologies

The power system simulator market is significantly influenced by the rising investment in smart grid technologies across the US. Utilities are increasingly adopting smart grid solutions to improve operational efficiency and enhance customer service. Utilities are increasingly adopting smart grid solutions to improve operational efficiency and enhance customer service. This shift is expected to drive the demand for simulation tools that can model the complex interactions within smart grids. The US smart grid market is anticipated to reach $100 billion by 2026, reflecting a CAGR of 10% from 2021. Consequently, the power system-simulator market stands to benefit from this trend as utilities seek to optimize their grid operations and integrate advanced technologies.

Emphasis on Energy Efficiency Initiatives

The power system simulator market is positively impacted by the growing emphasis on energy efficiency initiatives in the US. Government policies and incentives aimed at reducing energy consumption are prompting utilities to explore simulation tools. Government policies and incentives aimed at reducing energy consumption are prompting utilities to explore simulation tools that can optimize energy distribution and consumption. The US Department of Energy has set ambitious targets to improve energy efficiency by 30% by 2030. This regulatory push is likely to create a favorable environment for the power system-simulator market, as utilities seek to comply with these mandates while enhancing their operational capabilities.

Focus on Cybersecurity in Energy Infrastructure

The power system simulator market is increasingly shaped by the heightened focus on cybersecurity within energy infrastructure. As cyber threats to critical infrastructure become more prevalent, utilities are compelled to adopt simulation tools. As cyber threats to critical infrastructure become more prevalent, utilities are compelled to adopt simulation tools that can assess vulnerabilities and develop robust defense strategies. The US government has allocated significant resources to enhance cybersecurity measures in the energy sector, with investments expected to exceed $10 billion by 2026. This focus on cybersecurity not only drives demand for power system-simulator market solutions but also encourages innovation in developing tools that can simulate potential cyber-attack scenarios.