US Polyvinylidene Fluoride Market Summary

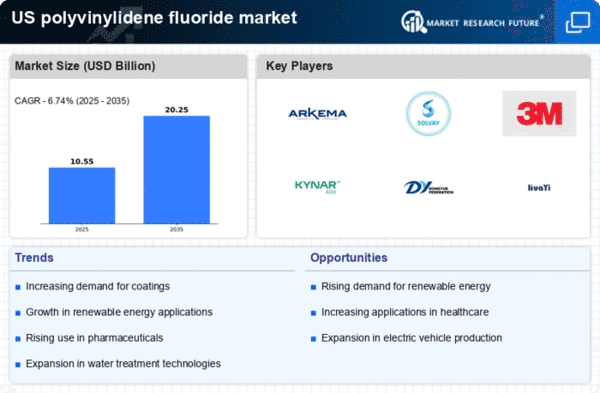

As per Market Research Future analysis, the US polyvinylidene fluoride market was estimated at 9.88 USD Billion in 2024. The US polyvinylidene fluoride market is projected to grow from 10.55 USD Billion in 2025 to 20.25 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US polyvinylidene fluoride market is experiencing robust growth driven by technological advancements and increasing demand across various sectors.

- The electronics segment is currently the largest, reflecting a rising demand for high-performance materials.

- Sustainability initiatives are gaining traction, influencing production methods and material choices.

- Technological advancements in production are enhancing the efficiency and quality of polyvinylidene fluoride.

- Key market drivers include growing applications in the energy sector and rising demand in the automotive industry.

Market Size & Forecast

| 2024 Market Size | 9.88 (USD Billion) |

| 2035 Market Size | 20.25 (USD Billion) |

| CAGR (2025 - 2035) | 6.74% |

Major Players

Arkema (FR), Solvay (BE), 3M (US), Kynar (US), Dongyue Group (CN), Shanghai Huayi (CN), Mitsubishi Chemical (JP), SABIC (SA)