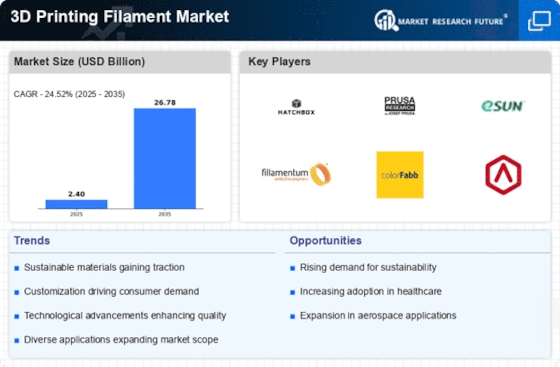

Rising Demand for Prototyping

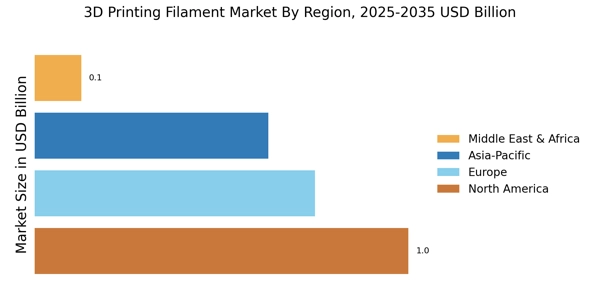

The 3D Printing Filament Market is experiencing a notable increase in demand for rapid prototyping across various sectors, including automotive, aerospace, and consumer goods. This trend is driven by the need for faster product development cycles and cost-effective manufacturing solutions. According to recent data, the prototyping segment is projected to account for a substantial share of the market, as companies seek to reduce time-to-market for new products. The ability to create functional prototypes using diverse filament materials enhances design flexibility and innovation. As industries continue to embrace additive manufacturing, the reliance on high-quality 3D printing filaments is likely to grow, further propelling the market forward.

Increased Adoption in Education

The integration of 3D printing technology in educational institutions is emerging as a key driver for the 3D Printing Filament Market. Schools and universities are increasingly incorporating 3D printing into their curricula to foster creativity and innovation among students. This trend is supported by the growing recognition of 3D printing as a valuable tool for teaching design, engineering, and technology. As educational institutions invest in 3D printers and associated filaments, the demand for high-quality printing materials is likely to rise. Reports indicate that the education sector could represent a significant portion of the market, as more institutions seek to equip students with practical skills relevant to modern industries.

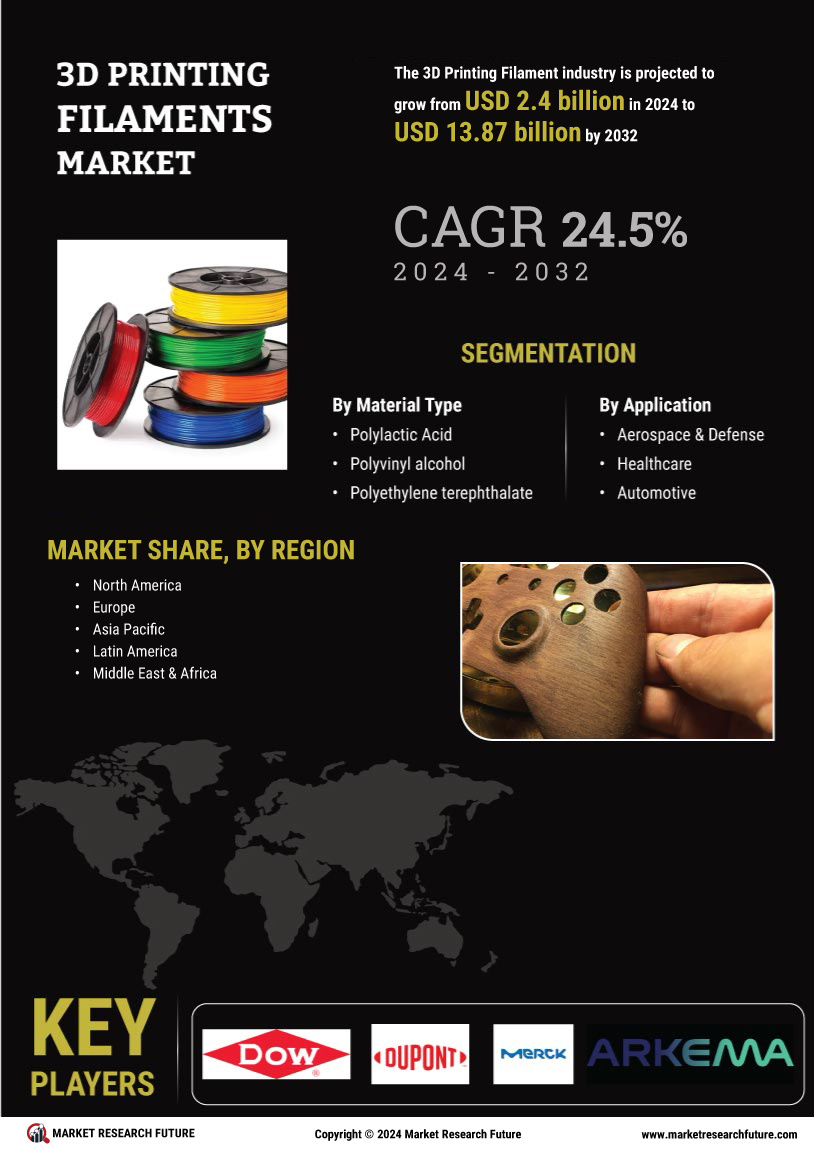

Advancements in Material Science

Innovations in material science are significantly influencing the 3D Printing Filament Market. The development of new filament types, such as bio-based and composite materials, is expanding the range of applications for 3D printing. These advancements not only improve the mechanical properties of printed objects but also cater to specific industry needs, such as heat resistance and durability. For instance, the introduction of filaments that mimic the properties of metals or ceramics is opening new avenues in sectors like healthcare and aerospace. As manufacturers continue to invest in research and development, the market is expected to witness a surge in the availability of specialized filaments, thereby enhancing the overall growth trajectory.

Surge in Consumer Electronics Production

The consumer electronics sector is witnessing a surge in the use of 3D printing technologies, which is positively impacting the 3D Printing Filament Market. As manufacturers strive to create customized and intricate designs for electronic devices, the demand for specialized filaments is increasing. This trend is particularly evident in the production of prototypes and end-use parts, where precision and material properties are critical. The market data suggests that the consumer electronics segment is expected to grow substantially, driven by the need for rapid design iterations and the ability to produce lightweight components. Consequently, this sector is likely to become a major contributor to the overall growth of the 3D printing filament market.

Growing Interest in Home-Based 3D Printing

The rise of home-based 3D printing is becoming a significant driver for the 3D Printing Filament Market. As more consumers acquire 3D printers for personal use, the demand for affordable and versatile filaments is increasing. This trend is fueled by the growing interest in DIY projects, hobbyist activities, and personalized product creation. Market analysis indicates that the home-use segment is expanding rapidly, with consumers seeking filaments that offer ease of use and compatibility with various printer models. As the market for home 3D printing continues to evolve, manufacturers are likely to respond by developing a wider range of filaments tailored to meet the diverse needs of individual users.