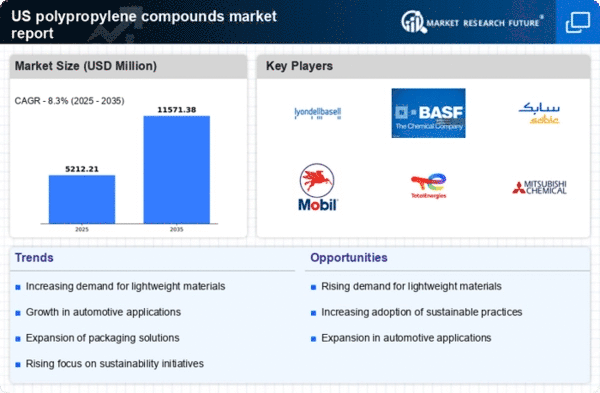

The polypropylene compounds market is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, packaging, and consumer goods. Key players are actively pursuing strategies that emphasize innovation, sustainability, and regional expansion to enhance their market positions. LyondellBasell Industries (US) has been focusing on expanding its production capabilities, particularly in North America, to meet the growing demand for high-performance polypropylene compounds. Meanwhile, BASF SE (Germany) is leveraging its extensive research and development resources to innovate in sustainable materials, which is becoming increasingly crucial in the current market environment. These strategic initiatives collectively shape a competitive environment that is increasingly focused on technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting significant influence. This fragmentation allows for a variety of competitive strategies, as companies seek to differentiate themselves through unique offerings and operational efficiencies.

In October ExxonMobil Chemical (US) announced a major investment in a new polypropylene production facility in Texas, aimed at increasing its output by 20%. This strategic move is expected to bolster its market share and enhance its ability to meet the rising demand for polypropylene compounds in the region. The investment underscores ExxonMobil's commitment to maintaining a competitive edge through capacity expansion and technological innovation.

In September SABIC (Saudi Arabia) launched a new line of sustainable polypropylene compounds designed for the packaging industry. This initiative reflects a growing trend towards environmentally friendly materials, positioning SABIC as a leader in sustainability within the market. The introduction of these products is likely to attract customers seeking to reduce their environmental footprint, thereby enhancing SABIC's competitive positioning.

In August TotalEnergies (France) entered into a strategic partnership with a leading technology firm to develop advanced recycling technologies for polypropylene. This collaboration aims to enhance the circular economy within the industry, allowing TotalEnergies to offer innovative solutions that align with global sustainability goals. Such partnerships are indicative of a broader trend where companies are increasingly looking to integrate sustainability into their core business strategies.

As of November the competitive trends in the polypropylene compounds market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to drive innovation and efficiency. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, reflecting the changing priorities of consumers and regulatory environments.