North America : Growing Demand for Lithium

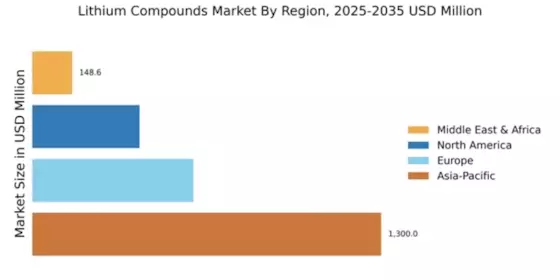

The North American lithium compounds market is poised for significant growth, driven by increasing demand from electric vehicle (EV) manufacturers and renewable energy storage solutions. With a market size of $400.0 million, the region is witnessing a surge in investments aimed at enhancing domestic production capabilities. Regulatory support for clean energy initiatives further catalyzes this growth, positioning North America as a key player in the global lithium landscape.

Leading countries such as the United States and Canada are at the forefront of this market, with major companies like Albemarle and Livent expanding their operations. The competitive landscape is characterized by strategic partnerships and technological advancements aimed at improving lithium extraction and processing. As the region focuses on sustainability, the presence of key players is expected to bolster market dynamics and drive innovation.

Europe : Sustainable Energy Transition

Europe's lithium compounds market is experiencing robust growth, with a market size of $600.0 million, fueled by the region's commitment to sustainable energy and electric mobility. The demand for lithium is primarily driven by the automotive sector, which is rapidly transitioning to electric vehicles. Regulatory frameworks, such as the European Green Deal, are pivotal in promoting lithium usage, ensuring a steady increase in market share.

Countries like Germany, France, and Sweden are leading the charge in lithium consumption, supported by key players such as SQM and FMC Corporation. The competitive landscape is marked by collaborations between automotive manufacturers and lithium producers to secure supply chains. As Europe aims for carbon neutrality, the lithium market is set to play a crucial role in achieving these ambitious targets.

Asia-Pacific : Dominating Global Lithium Supply

The Asia-Pacific region dominates the lithium compounds market, boasting a substantial market size of $1,300.0 million. This growth is driven by the increasing demand for lithium-ion batteries in consumer electronics and electric vehicles. Countries like China and Australia are leading producers, with favorable regulations supporting mining and production activities. The region's market share reflects its strategic importance in the global supply chain for lithium compounds.

China, in particular, is home to major players like Ganfeng Lithium and Tianqi Lithium, which are expanding their production capacities to meet rising global demand. The competitive landscape is characterized by aggressive investments in technology and sustainability practices. As the region continues to innovate, its leadership in the lithium market is expected to strengthen further, ensuring a robust supply for future applications.

Middle East and Africa : Emerging Lithium Potential

The Middle East and Africa region is emerging as a potential player in the lithium compounds market, with a market size of $148.56 million. The growth is primarily driven by increasing interest in lithium for battery production and renewable energy applications. As countries in this region explore their mineral resources, regulatory frameworks are being developed to support sustainable mining practices, which could enhance market share in the coming years.

Countries like South Africa and Namibia are beginning to attract investments in lithium mining, with companies like Orocobre and Galaxy Resources exploring opportunities. The competitive landscape is still developing, but the presence of key players is expected to catalyze growth. As the region capitalizes on its mineral wealth, the lithium market is likely to see significant advancements and increased global relevance.