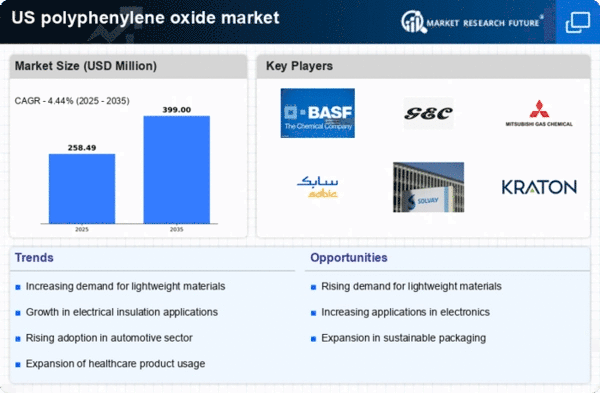

The polyphenylene oxide market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as BASF SE (Germany), General Electric Company (US), and SABIC (Saudi Arabia) are actively shaping the market through their distinct operational focuses. BASF SE (Germany) emphasizes sustainability and innovation, investing in advanced materials that enhance performance while reducing environmental impact. General Electric Company (US) leverages its technological prowess to integrate digital solutions into its manufacturing processes, thereby improving efficiency and product quality. Meanwhile, SABIC (Saudi Arabia) is pursuing regional expansion and strategic collaborations to enhance its market presence and diversify its product offerings. Collectively, these strategies contribute to a competitive environment that prioritizes technological advancement and sustainability.The market structure appears moderately fragmented, with several players vying for market share through localized manufacturing and optimized supply chains. Companies are increasingly focusing on regional production to mitigate supply chain disruptions and enhance responsiveness to local market demands. This localized approach, coupled with strategic partnerships, enables firms to strengthen their competitive positions while addressing the evolving needs of customers.

In October BASF SE (Germany) announced a partnership with a leading automotive manufacturer to develop polyphenylene oxide-based components aimed at reducing vehicle weight and enhancing fuel efficiency. This collaboration underscores BASF's commitment to innovation and sustainability, aligning with the automotive industry's shift towards lightweight materials. The strategic importance of this partnership lies in its potential to capture a significant share of the growing demand for eco-friendly automotive solutions.

In September General Electric Company (US) unveiled a new digital platform designed to optimize the production of polyphenylene oxide materials. This platform integrates AI and machine learning to streamline operations and improve product consistency. The introduction of this technology is likely to enhance GE's competitive edge by reducing production costs and increasing output efficiency, thereby meeting the rising demand for high-performance materials in various applications.

In August SABIC (Saudi Arabia) expanded its production capacity for polyphenylene oxide in North America, responding to the increasing demand from the electronics and automotive sectors. This strategic move not only strengthens SABIC's market position but also reflects a broader trend of companies investing in capacity expansion to meet growing consumer needs. The expansion is expected to enhance supply chain reliability and reduce lead times for customers.

As of November the competitive trends in the polyphenylene oxide market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances are becoming pivotal in shaping the landscape, as companies seek to leverage each other's strengths to drive innovation. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident, suggesting that future competitive advantages will hinge on the ability to innovate and adapt to changing market dynamics.