Increasing Focus on Sustainability

The Global Polyphenylene Sulfide Market Industry is increasingly influenced by the growing focus on sustainability and environmental responsibility. Manufacturers are under pressure to adopt eco-friendly materials and processes, leading to a heightened interest in polyphenylene sulfide due to its recyclability and reduced environmental impact compared to traditional materials. This shift is prompting companies to invest in sustainable practices, which may enhance the market's appeal. As global regulations become more stringent regarding material usage and waste management, polyphenylene sulfide is positioned to play a crucial role in meeting these new standards.

Rising Demand in Automotive Sector

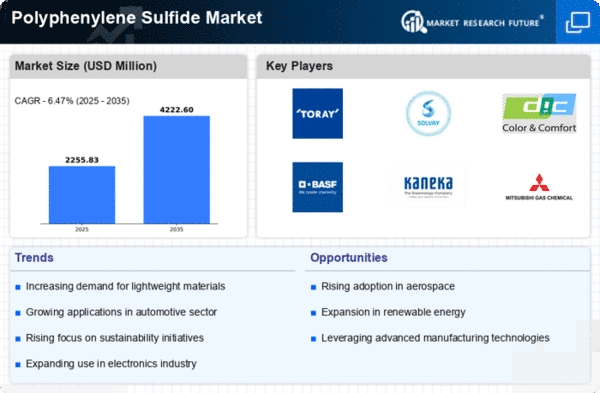

The Global Polyphenylene Sulfide Market Industry is experiencing a notable surge in demand driven by the automotive sector. As manufacturers increasingly seek lightweight and high-performance materials, polyphenylene sulfide is emerging as a preferred choice due to its excellent thermal stability and chemical resistance. In 2024, the market is projected to reach 2.09 USD Billion, with automotive applications accounting for a significant share. This trend is likely to continue as the industry shifts towards electric vehicles, which require advanced materials for components such as connectors and housings, thereby enhancing the overall market potential.

Expanding Applications in Aerospace

The Global Polyphenylene Sulfide Market Industry is poised for growth as the aerospace sector increasingly adopts polyphenylene sulfide for various applications. The material's lightweight nature and exceptional thermal and chemical resistance make it suitable for components such as fuel systems and structural parts. As the aerospace industry continues to innovate and seek materials that enhance performance while reducing weight, polyphenylene sulfide is likely to gain traction. This trend is expected to contribute to the overall market growth, aligning with the projected increase from 2.09 USD Billion in 2024 to 4.22 USD Billion by 2035.

Advancements in Manufacturing Technologies

The Global Polyphenylene Sulfide Market Industry is benefiting from advancements in manufacturing technologies that enhance the production efficiency and quality of polyphenylene sulfide. Innovations such as improved polymerization processes and additive manufacturing techniques are enabling manufacturers to produce high-performance materials with tailored properties. This evolution not only reduces production costs but also expands the range of applications for polyphenylene sulfide across various industries. As these technologies continue to develop, they are likely to drive market growth, allowing for greater adoption in sectors such as aerospace and medical devices.

Growth in Electronics and Electrical Applications

The Global Polyphenylene Sulfide Market Industry is witnessing substantial growth fueled by the electronics and electrical sectors. The material's superior electrical insulation properties and thermal stability make it ideal for manufacturing components such as circuit boards and connectors. As the demand for miniaturization and efficiency in electronic devices increases, polyphenylene sulfide is becoming increasingly relevant. The market is expected to expand significantly, with projections indicating a growth from 2.09 USD Billion in 2024 to 4.22 USD Billion by 2035, reflecting a compound annual growth rate of 6.61% from 2025 to 2035.