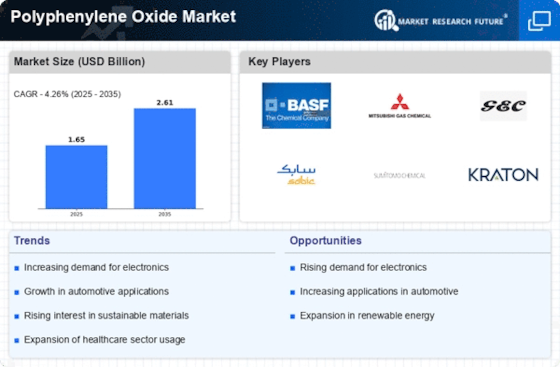

Leading market players are investing heavily in research and development to spread their product lines, which will help the Polyphenylene Oxide Market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The Polyphenylene Oxide industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Polyphenylene Oxide industry to benefit clients and increase the market sector. In recent years, the Polyphenylene Oxide industry has offered some of the most significant advantages to medicine.

Major players in the Polyphenylene Oxide Market, including BASF SE (Germany), SABIC (Saudi Arabia), RTP Company (US), Celanese Corporation (US), Ensinger Inc. (India), Mitsubishi Electric Corporation (Japan), 3M (US), Goodfellow (UK), Asahi Kasei Chemicals Corp. (Japan), Solvay SA (Belgium), Sumitomo Chemical Co., Ltd (Japan), LyondellBasell Industries Holdings BV (Netherlands), and others, are attempting to increase market demand by investing in research and development operations.

BASF SE, also known as Badische Anilin und Soda-Fabrik, founded in 1865, located in Ludwigshafen, Germany, is a European company that is the largest producer of chemicals in the world. The products included are dyes, soda, sulfuric acid, ammonia, rubber, fuels, carbon, and many more.

In June BASF will build a commercial-scale battery recycling black mass plant in Schwarzheide, Germany. BASF will offer a range of chemical intermediates with a product carbon footprint significantly below the market average.

DIC Corporation, founded in 1908, and located in Chiyoda Ku, Tokyo, Japan, is a Japanese chemical company specializing in developing, manufacturing, and selling inks, polymers, pigments, plastics, biochemicals, and compounds. It operates worldwide and includes Sun Chemical Corporation, which is based in America and Europe.

In April DIC Corporation resolved to revise its sales prices for DIC PPS polyphenylene sulfide (PPS) products. The company has started to apply higher sales prices for the products shipped after April 2022.

In 2022, LG Chem created a fire-resistant material that it claims can withstand temperatures of up to 1,000°F, the temperature at which lithium explodes. At the same time, Henkel has introduced two new protective coatings intended to safeguard battery housings from heat and fire. The Korean chemical manufacturer claimed its flame-retardant plastic, composed of polyphenylene oxide (PPO), polyamide (PA), and polybutylene terephthalate (PBT), could withstand fires at 1,000°F for up to 400 seconds. As a result, it offered 45 times greater resistance than existing flame-retardant polymers.