Urbanization and Congestion

Rapid urbanization in the United States is contributing to increased traffic congestion, prompting a shift towards personal transporters. As cities expand, the need for efficient and compact transportation options becomes more pressing. The personal transporter market is responding to this demand by offering solutions that alleviate congestion and provide convenient mobility. Data suggests that urban areas are experiencing a 20% increase in demand for personal transporters, particularly in densely populated regions. This trend indicates a growing acceptance of alternative modes of transport, such as e-scooters and electric bikes, which are well-suited for navigating crowded urban environments. Consequently, the personal transporter market is poised for growth as urban dwellers seek practical solutions to their commuting challenges.

Shift in Consumer Preferences

There is a notable shift in consumer preferences towards more flexible and convenient modes of transportation, which is positively influencing the personal transporter market. As lifestyles evolve, individuals are increasingly seeking alternatives to traditional car ownership, favoring options that offer greater mobility and ease of use. The personal transporter market is adapting to this trend by providing a diverse range of products, including foldable e-bikes and compact scooters. Market Research Future indicates that approximately 40% of consumers are considering personal transporters as viable alternatives for short-distance travel. This shift in preferences suggests a growing acceptance of personal transporters as practical solutions for daily commuting, thereby driving market growth.

Growing Environmental Awareness

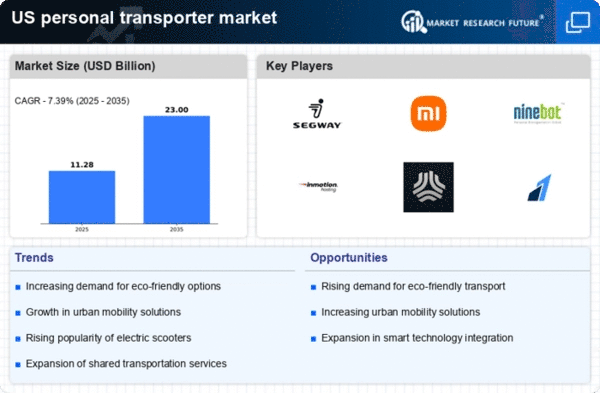

The increasing concern for environmental sustainability is driving the personal transporter market. Consumers are becoming more conscious of their carbon footprints and are seeking eco-friendly alternatives to traditional vehicles. This shift in consumer behavior is reflected in the rising demand for electric scooters and bicycles, which are perceived as greener options. According to recent data, the market for electric personal transporters is projected to grow at a CAGR of 15% through 2027. This trend indicates a significant opportunity for manufacturers to innovate and develop products that align with eco-conscious values. The personal transporter market is thus likely to benefit from this heightened awareness, as consumers prioritize sustainable transportation solutions.

Technological Advancements in Battery Life

Advancements in battery technology are significantly impacting the personal transporter market. Improved battery efficiency and longevity are enabling longer travel distances and reducing charging times, which enhances the overall user experience. The personal transporter market is witnessing innovations such as lithium-ion batteries that offer higher energy densities and faster charging capabilities. Recent studies indicate that the average range of electric scooters has increased by 30% due to these technological improvements. As battery technology continues to evolve, it is likely that consumer confidence in electric personal transporters will grow, further driving market expansion. This trend suggests that manufacturers who invest in cutting-edge battery solutions may gain a competitive edge in the personal transporter market.

Government Incentives for Electric Vehicles

Government initiatives aimed at promoting electric vehicles are playing a crucial role in the personal transporter market. Various federal and state programs offer incentives such as tax credits and rebates for consumers purchasing electric scooters and bikes. These financial incentives are designed to encourage the adoption of cleaner transportation options, thereby supporting the personal transporter market. Recent data indicates that states with robust incentive programs have seen a 25% increase in electric vehicle sales, including personal transporters. This trend suggests that as government support continues, the market for electric personal transporters is likely to flourish, attracting a broader consumer base and fostering innovation within the industry.