Personal Care Packaging Market Summary

As per Market Research Future analysis, the Personal Care Packaging Market was estimated at 33.72 USD Billion in 2024. The Personal Care Packaging industry is projected to grow from 35.9 USD Billion in 2025 to 67.22 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.47% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Personal Care Packaging Market is experiencing a transformative shift towards sustainability and technological integration.

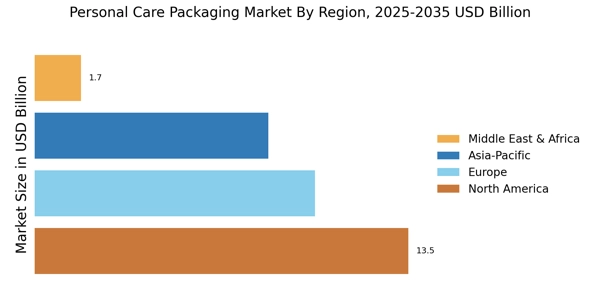

- Sustainable materials adoption is becoming increasingly prevalent, particularly in North America, which remains the largest market.

- Technological integration is enhancing packaging functionality, appealing to consumers in both the skincare and haircare segments.

- Customization and personalization trends are gaining traction, especially in the fast-growing haircare segment in Asia-Pacific.

- Market drivers such as sustainability initiatives and e-commerce growth are significantly influencing packaging choices across the industry.

Market Size & Forecast

| 2024 Market Size | 33.72 (USD Billion) |

| 2035 Market Size | 67.22 (USD Billion) |

| CAGR (2025 - 2035) | 6.47% |

Major Players

Amcor (AU), Berry Global (US), Sealed Air (US), Mondi Group (GB), Albea (FR), Crown Holdings (US), Graham Packaging (US), Silgan Holdings (US), WestRock (US)