Rising Healthcare Expenditure

The upward trend in healthcare expenditure in the US is a significant driver for the peptic ulcer-drugs market. With healthcare spending projected to reach approximately $4.1 trillion by 2025, there is an increasing allocation of resources towards gastrointestinal health. This financial commitment enables healthcare providers to invest in advanced treatment options and medications for peptic ulcers. Additionally, insurance coverage for ulcer treatments is improving, making medications more affordable for patients. As a result, the demand for effective peptic ulcer therapies is likely to rise, contributing to the overall growth of the market. The correlation between healthcare expenditure and drug accessibility suggests a promising outlook for the peptic ulcer-drugs market.

Advancements in Drug Formulations

Innovations in drug formulations are significantly influencing the peptic ulcer-drugs market. The development of novel therapeutic agents, including targeted therapies and sustained-release formulations, enhances treatment efficacy and patient compliance. For instance, the introduction of new proton pump inhibitors (PPIs) and H2-receptor antagonists has expanded the treatment landscape. Market data indicates that the PPI segment alone accounts for over 50% of the total market share, reflecting the demand for effective ulcer management solutions. Additionally, the emergence of biosimilars and generic drugs is likely to provide cost-effective alternatives, making treatments more accessible to patients. As pharmaceutical companies invest in research and development, the introduction of advanced formulations is expected to bolster the peptic ulcer-drugs market.

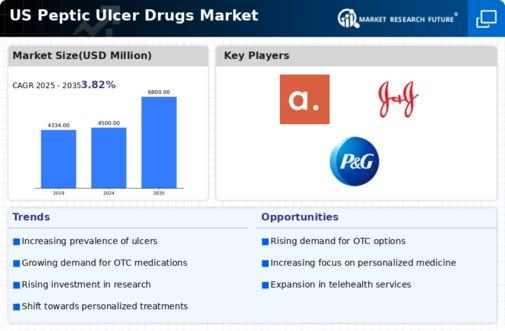

Growing Prevalence of Peptic Ulcers

The rising incidence of peptic ulcers in the US is a primary driver for the peptic ulcer-drugs market. Factors such as increased stress levels, dietary habits, and the prevalence of Helicobacter pylori infections contribute to this trend. According to recent health statistics, approximately 4.5 million individuals in the US are diagnosed with peptic ulcers annually. This growing patient population necessitates effective treatment options, thereby propelling the demand for various drugs in the peptic ulcer-drugs market. Furthermore, the aging population, which is more susceptible to gastrointestinal disorders, is likely to increase the market size. As healthcare providers seek to address this issue, The emphasis on innovative drug formulations and therapies is expected to intensify, further driving market growth.

Regulatory Support for Drug Approvals

Regulatory support for the approval of new drugs is a crucial factor influencing the peptic ulcer-drugs market. The US Food and Drug Administration (FDA) has streamlined the drug approval process, facilitating quicker access to innovative treatments for peptic ulcers. This regulatory environment encourages pharmaceutical companies to invest in research and development, leading to the introduction of new therapies. Recent approvals of novel medications have expanded the treatment options available to healthcare providers and patients alike. As the regulatory landscape continues to evolve, it is expected that more effective and diverse treatment options will emerge, thereby enhancing the growth potential of the peptic ulcer-drugs market.

Increasing Awareness of Gastrointestinal Health

There is a notable increase in awareness regarding gastrointestinal health among the US population, which is positively impacting the peptic ulcer-drugs market. Educational campaigns and healthcare initiatives aimed at promoting digestive health have led to a greater understanding of peptic ulcers and their treatment options. This heightened awareness encourages individuals to seek medical advice and treatment, thereby increasing the demand for ulcer medications. Furthermore, the rise of digital health platforms and telemedicine has facilitated access to healthcare professionals, allowing patients to receive timely interventions. As awareness continues to grow, it is anticipated that more individuals will be diagnosed and treated for peptic ulcers, further driving the market.